Setting up a Delaware company – Consider income tax & franchise tax

Recently, we have been recently setting up two companies in Delaware. We will operate shares management platform which will help startups in managing their company shares. If you are in a position of setting up a company and you will be in need of CapTable (Capitalization Table – here is short description of our new project) which helps you to distribute shares to employees, investors (VC or Angel investors) or third party providers.

We have chosen Delaware as it is the most common practice because it has favorable law structure. You can enjoy many benefits. You will also be required to incorporate in Delaware if you will ask for investment from Venture Capital firms.

There is much confusion about Delaware corporate taxes. Here is a short explanation of how to understand the process.

Before you set up your company:

- State Incorporation Fees $89 (also known as filing fee)

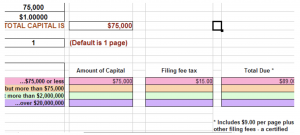

If the capital is less than $75,000 then only the $89 Article filing fee is due.

Example: this is for $75000 capital (75000 shares x $1.00 par value=$75000 capital)

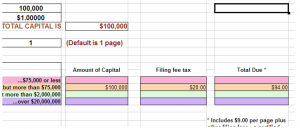

If the capital is more than $75,000 then there would be an additional fee…

Example: If the capital is $100,000 (100,000 shares x $1.00 par value = $100,000 capital) the Articles filing fee would be $94.00 (not $89.00)

So the Article filing fee depends on the total Capital.

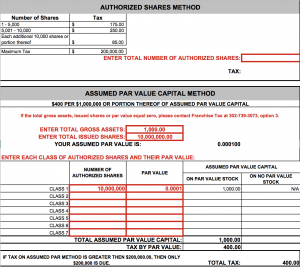

- Franchise tax – never less than $175 (Assumed Par Value Capital Method)

Before you set up any company, please make sure that your shares have value per share e.g. 1share = 0.0001 otherwise you will have to file taxes based on the Authorized Shares Method.

Franchise tax might be one of the biggest burdens for any incorporating startup. I would suggest for you to issue 10,000,000 shares, each share priced at 0.0001$ (10,000,000 shares x 0.0001$ per share = $1,000) In fact, a fraction of a cent is the commonly recommended amount. Keeping par value low means that stock can be purchased affordably in early stages when the company is worth virtually nothing. You must also mention the total gross assets. We started at $1,000 as this might reflect the incorporation fees of the company and therefore this covers the total cost and value.

The reasons to go with 10,000,000 shares:

- You would like to issue 3,500,000 among the founders

- 3,500,000 shares are booked for Venture Capital firms

- 3,000,000 shares are booked for employees and third party providers (in case you want to award shares to lawyers or third party providers)

Here is the franchise tax calculator.

Annual taxes & fees:

- Annual Report $50

- The Franchise Tax for a corporation is due by March 1 of every year.

- Delaware income tax:

- If you conduct business in Delaware, you pay 8.7%

- If you do not conduct business in Delaware you pay 0%

Federal income tax:

- You pay flat 21% corporate tax