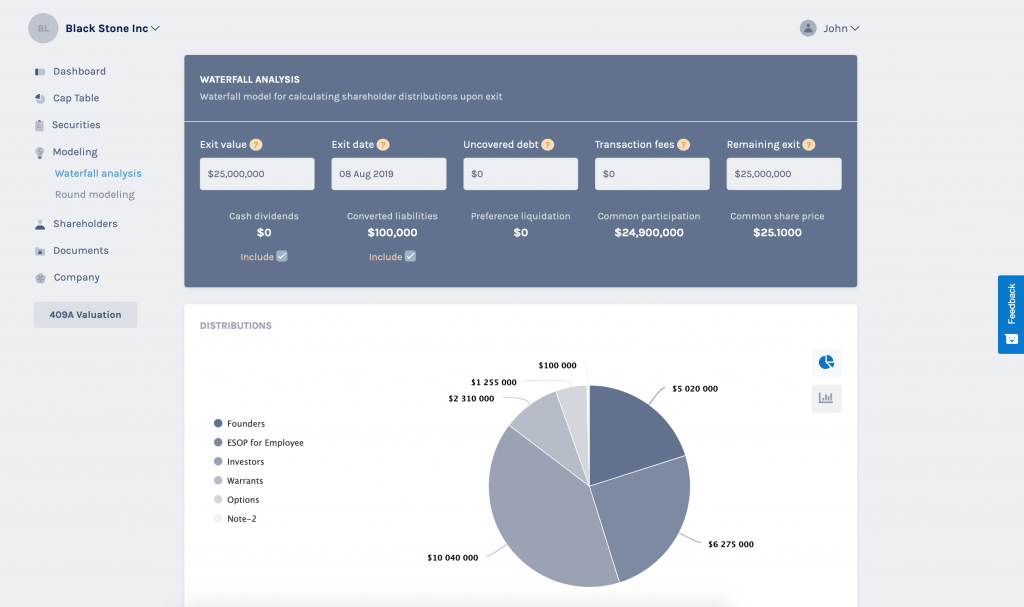

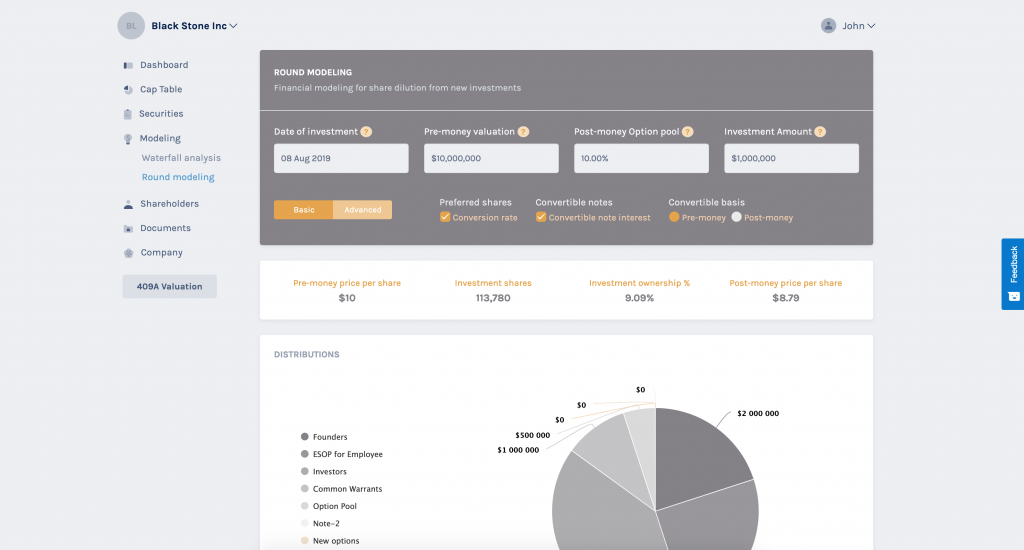

Round Modeling & WaterFall Analysis – CapTable

I’m so excited our entire team was working on WaterFall Analysis and Round Modeling. It took us longer than expected, but we can say that we are there! It’s deployed in production so you can check it out yourself.

Waterfall Analysis – allowing you to model exit scenarios for your company and understand the economic impact on shareholders and equity classes. It’s also called exit analysis

Round Modeling – allowing you to model new preferred financing rounds for your company and understanding the impact it will have on your company’s capitalization structure. You are able to see different scenario to the current captable.

Our CapTable is getting stronger!

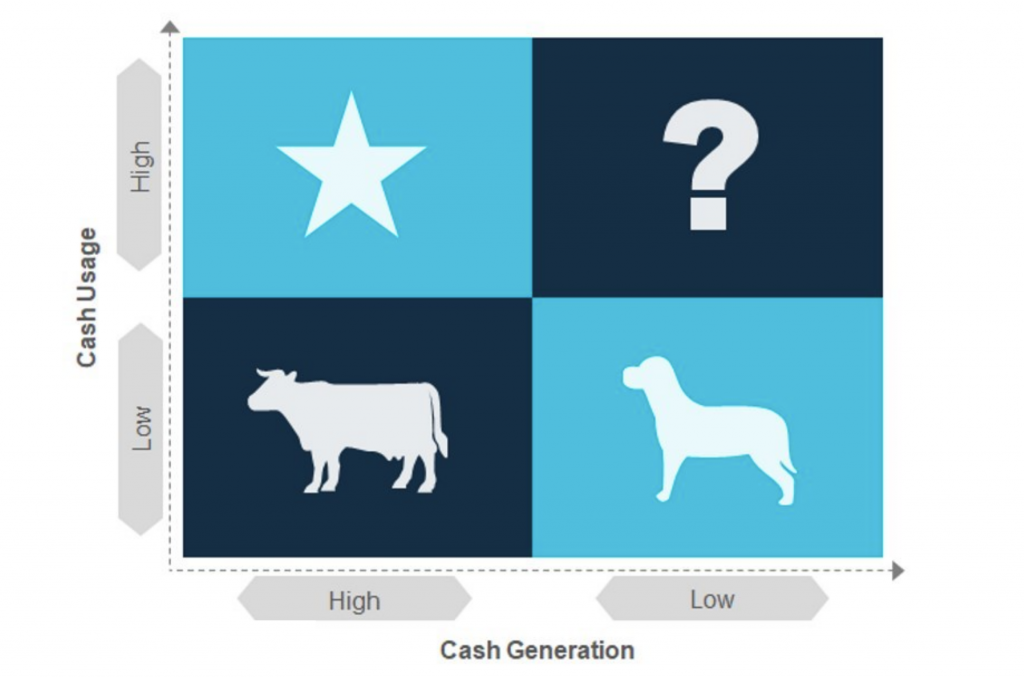

BCG Matrix in 2019

I guess everyone knows what it’s the BCG Matrix, right? For those who are not sure, it’s a matrix covering the product life cycle vs the usage of cash. You might read many explanations, but what about looking at them from the Silicon Valley perspective.

QUESTION MARK – it’s technically the early stage product and anything you launch and don’t have any idea if your products are successful or will thrive. Cash generation is very low, you have practically no clients and nobody is buying your product so your intention is to move to Star; you can technically keep up with the cash usage from the client who is generating the cash. This must happen very quickly as you can’t burn money.

DOG – this is the time to rethink if your venture makes sense or not. You keep burning money, it’s not as high as in “Question mark” stage, but it’s high enough to realize that your company or products are not successful. Rethink your strategy; get things right and start over again. It’s most difficult to shift to Star if the drive you had is gone and you need to refocus. You and your money dried up!

STAR – this is the most positive part of the entrepreneurship. You might get to the stage of your venture when you create something brilliant and unique! Everyone will love it! Your company generates plenty of cash so you can cover the cash usage and develop your company as you want. You are in tune with the growth of your company and you can do whatever you want, it is the most enjoyable part of your endeavor!

COW – this is the perpetuum mobile where the company keeps generating cash and you know that there is no extra cent you need to spend to keep that COW alive. The best way to prove COW stage, it’s to set up the company as “owner absentee” and have a manager to run it. This part is great when you run additional companies or are starting a new one. A company generating cash is a brilliant opportunity to start something new as you don’t need to put effort to generate cash.

If I look at today’s Silicon Valley companies none of them are pure COW, STAR, DOG or QUESTION MARK. Well, what I meant that today’s Silicon Valleys companies (the successful one, mid-size, and small size) are mostly burning more money that can be seen as STAR. It will still need cash to generate additional funds and on top of that, these companies receive additional capital to prevent them from falling to the other segments. These companies might be seen as SUPER-STAR – generating and spending cash plus raising extra money to keep growing and generating more funds, which will eventually be burned. This is today’s BCG Matrix in Silicon Valley. SUPER-STAR fundraising from investors as well as generating cash flow from clients is equal to debt! Nobody is interested in the cash COW!

And finally, why did I write this post? Well, we got contacted by one of the BCG representatives! I can’t be more excited, I don’t want to say which of our companies, but it’s proof that we do “something” right! If the deal will not go through, the fact that we have been contacted by one of the most prestigious companies in the world speaks for itself! I remember the day when my teacher of economics taught us about this matrix and now we have the chance to work with this brilliant company.

I have the feeling that I need to jump on the plane and talk to them. I just love these guys! They have been my STAR and COW all my life!

The Most Fair Internal Revenue Service – IRS

Since most of us know the tax department as IRS (Internal Revenue Service). Actually, we call the Hong Kong tax authority the Inland Revenue Department (IRD).

You set up your company and get the business profitable, right? This practice is the ideal scenario. There is a section in the District Court Ordinance claiming that if for any reason you overpay the company tax to Hong Kong IRD, you might be entitled in a refund and additional profit which is calculated as an interest rate of 8.088 % per anum in Jan 2019.

Seeing this letter from IRD, I was not sure whether this was right, but as I talked to one of our CPAs, I was ensured that this is indeed the case.

The IRD has a practice where they make sure that you don’t overpay them, for reasons that you may intentionally pay them more than you should in order to profit from 8.088 %.

I think that this would be the best business model in the world; you put money into the IRD deposit and then you receive a refund.

- You are 100% sure that the government will not shut down as some of the banks have

- You get an excellent return of over 8 %

I’m certain that this is a brilliant deal 🙂

How is it in the US? If you overpay the US IRS

Well, I’m just trying to make a point that I’m a big fan of HK government, it’s the most straightforward and fair government in the entire world.

So if you are thinking of why Hong Kong is ranked as the freest economy and the easiest to do business, this might be one of them. Of course, you don’t overpay the government to benefit from the overpay. I’m just trying to make a point where most of the governments try to get provision tax or get so many advance payments, and in case you overpay them, it’s your mistake! You must ask the local IRS to get a refund or keep the amount as a deposit for the incoming tax bill.

Also, there is a big mistake thinking that Hong Kong is an offshore jurisdiction. Well, if you set up a company in Hong Kong, you automatically pay 16.5% tax (for the first $2,000,000 HKD it’s 8.25% and then 16.5%). Hong Kong company income tax is an automatic thing; there is no such thing as offshore. What you want to know is that you might get a tax exemption. There is a tax rule where you need to pass the tax test to receive the tax exemption status (but you should also explain why you are based in Hong Kong, e.g. trading with China or doing business in surrounding countries):

- You are not a tax resident in HK

- Your employees are not based in HK

- You don’t have an office in HK

- You aren’t doing business in HK (invoicing local companies)

It’s quite interesting to see the differences in administrative burdens in every different country.

I just like Hong Kong; it’s a very pro-business place. There is no way any other country can beat HK. It’s the place where I started.

Most of our clients enjoy the benefits of this jurisdiction.

Silicon Valley Bank Account Opening For Tech Startups

Since we facilitate company formation in all the US it’s important for every company to get a bank account because there are many banks out there offering business accounts, however, a few banks can do what Silicon Valley Bank can offer.

You can get a bank account with SVB in a matter of days without visiting them. Imagine you start out incorporating your tech startup in Delaware but you need a bank account. Very few banks offer bank accounts for businesses if they are not registered in their state. Usually, if you fly to Delaware to open your business bank account, the bank account will be opened the same day following the due diligence approval. Most of the investors or tech companies register in the state of Delaware, there is no surprise that more than three-quarters of Fortune 500 companies registered in this state. The Delaware SoS (Secretary of State) reported over 200,000 companies registered in 2016! This is a really high number! So there is a big benefit for registering in Delaware, however, this raises the question if, in addition, you should register in another state – this is for another blog post. If you operate in more than one state, have office or employee, you should register in the same state as well in which case you can open a bank account with a local bank.

The advantage is that SVB will not require you to visit them. They run their own KYC (Know Your Client) so you might be pretty much surprised that you might not meet the banker. All documents are signed over the DocuSign – electronically. But it is better to generate your own signature rather than using the DocuSign signature style. This will allow you to avoid meeting the banker in person.

SVB requirements:

- SVB requires you to register a US-based entity

- Must be in the tech industry (pharmaceutical, internet, hardware, IoT, etc.)

- Detailed business description

- Company documents: Articles of Association, EIN, Minutes of Initial Meeting of Directors Breakdown of Company Ownership (25% or greater) – you will need their mailing address, date of birth and social security number or government ID information (no need of physical documents, you will just upload them over their online onboarding system)

- Personal document: Driving license, Passport or National ID, The founder should have SSN (SSN is a big help if not National ID)

Fees: SVB Startup Solution does not have a monthly account fee for the first three years. It also waives the fees for Online Banking, Bill Pay, and Mobile Deposit. Additionally, you receive 2 domestic outgoing wires, 1 international FX outgoing wire, and 5 USD incoming wires at no cost.

Time/duration of bank account opening: 3-5 working daysIf you’re interested in opening a bank account for your Tech company, please e-mail me; I’m happy to introduce you, however, you need to be an Incparadise client and have a company registered with us. The bank will only accept tech companies. I know a few employees from SVB and they are all very helpful for legit business! If you’re not a legit business, please don’t contact me. I’m ONLY interested in tech businesses where the founders are serious and dedicated people to their endeavor.

174 Eqvista Visitors After a Few Weeks Launch

Why did we come up with eqvista.com? I just couldn’t believe that people were still managing their shares in paper format and would still print the company shares certificates and managing them with the Registrar of Members. I have seen thousands of companies printing company shares on paper. Incparadise & Startupr setting up over one and a half thousand companies every year would create it a few piles of paper to file! Since we are a registered agent, we can see many cases like that. Well, that’s the story made short.

It usually takes some time to get the API right. We launched Eqvista just a few weeks ago, the MVP is up and running, I was impatient; pushing my IT team to release the first version as soon as possible.

Another very important thing is that we have completely changed the forms (where you fill out all information about the security details – share certificates, SAFE, KISS, Vesting schedule, etc.) All forms are now much clearer and easier to use. Somebody was really thinking about the UX. The second advantage is that we have huge synergy with eastbiz.com and incparadise.net.

The result of this preparation was 170 visitors in one single day, a very good number. We have launched many online projects over the years in order to get traffic fast; you need to make sure that your product is great. Since eqvista is SaaS, it’s even harder; each part of the software you code is immediately a product.

The target is to have the average length of a session (Google analytics) as high as possible. The ideal average session would be around 30-35 minutes. We are now at 13minutes per session which is not too bad since the app has been launched just a few weeks ago.

As we will add more functions, the length of each session will be automatically longer. I can imagine that any professional working on cap table might use our app for hours. Any law firm can have 5-10 clients that would extend the time on the app.

We now have a list of tasks which we are working on, it will be an ongoing project! We have many great ideas.

Setting Up a Bank Account for Delaware Company

Startups usually choose to set up a Delaware entity because many of the companies will ask to do so. However, there is a stigma why people think of setting up a company in Delaware as the startup scene dictates that this is the standard. Well, this might be true, but it complicates the process.

Delaware fees seem to be low. You usually set up a company with 10,000,000 shares and $0.00001 par value. You end up being taxed on the value of $100 (10,000,000 shares x $0.00001) including incorporation fees. So the Delaware franchise tax is calculated based on the authorized shares of the company or value of the shares, whichever is higher.

So, let’s say you register your company in Nevada and you want to operate your company in Delaware. There is this thing called Foreign Qualification (FQ) you might be required to fulfill.

You will need to provide standard company documents to get a bank account opened for your DE company and operating from NV.

You also need to provide, within one year, articles of incorporation, EIN and current Certificate of Good Standing or printed online verification of Active Status from originating state, Filed List of Officers or printed verification of officers from Nevada Secretary of State (for corporations conducting business in Nevada). Which means you will need to pay two business licenses and file two annual lists with each state!

There are a few ways to fix this:

- You open a bank account in Delaware

- You register the company in a place where you run the business

- You get Foreign Qualification for your company if the original state is different from the state where you should apply for foreign status

- You domicile the company in the state where you are opening a bank account

- Or you might find some bank which accepts the company located in out of state; the Silicon Valley Bank (svb.com) offers services for tech startups

The above is just an example; you might be located in different states, however, you have got the idea of the possible options.

Here is some advice in case you register your office in any of the states below, where you might register in the alternate state (in our case it is Nevada). The compliance test usually covers the key factors of whether you run the business in the state or not. If any of the following points are related to you, then you should register your company in the state as well:

- Your bank (or any other government body or institution) requires you to file for FQ in the state

- Revenue is earned from doing business in NV (Revenue was earned in NV. The corporation conducts, sells, and solicits for business in NV and receives revenue as a result of the activity)

- You rent an office in NV

- You have employees in NV

- Own based asset in the state (e.g., any properties)

- Delaware or Nevada Registered agent is an excellent option if you’re not based in that state. If you’re not registered in DE or NV, it’s always good to hire a registered agent; They usually charge around $100

Delaware or Nevada Registered agent is actually a great option if you’re not based in that state.

The above example is for the DE and NV option. Here are the DE and CA option. Your tech startup is registered in Delaware and operating in/from California.

Since we have many startups in California and are conducting intrastate business, it is better also to register your business in CA. The multi-state registration will trigger multiple fees on annual bases – Franchise Tax, business license fees, and Annual list fee.

- Incorporation Delaware State fee $90

the minimum tax for the Assumed Par Value Capital Method of calculation is $400.00

- The filing fee for the CA Statement is $100 (plus $5 to get a file-stamped copy back) and $50 for a Certificate of Good Standing from Delaware (which is required to file the Statement and Designation)

- California will trigger the minimum franchise tax of $800 once you file for Delaware Foreign Qualification

If you run a tech company you might open a bank account with Silicon Valley Bank and you may not need to register in California or any other state, but check with the bank first. The opening of an SVB account is done online (e-signature to sign bank account opening documents – no need for a wet signature or physical presence). Once you pass the due diligence process, you might get the bank account opened in a matter of 3-5 working days. Since the bank is pro-startup, they will definitely help you out.

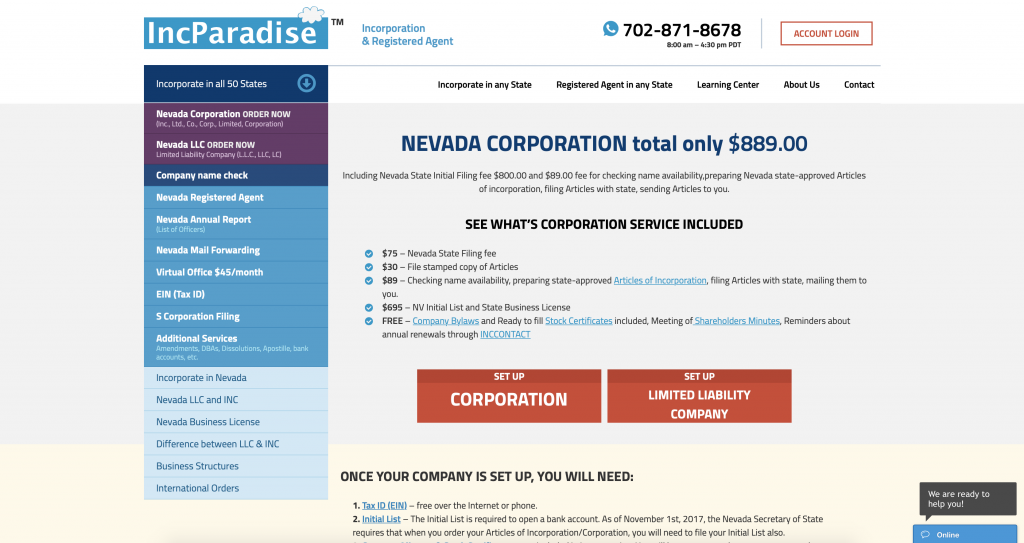

We have rebuilt IncParadise website

I’m so happy that we have finally released our new web for IncParadise. It was quite a significant work as we have over 3,000 pages on this web! Yes, it’s 3,000 pages which had old design.

Neil Patel had advised me not to change anything when I met Neil back in September of 2017. The reason was that you might drop in Google search ranking quite significantly. Well, since we do everything right! I hope that the new code will increase the speed and Google ranking as Google matrix has many variables – the cleanness of the code and speed of reloading your website is quite important.

So here we are, 18months late and we got a new website! The idea was not to change the old UX and refresh UI. As you can see we still keep the colors although not my favorite! We still need to keep the elements of old design since we got over 4,000 clients and they use the system a lot, so I don’t want to confuse them with an entirely new design. I was pushing my team for a long time since they work on many products and projects; we decided to release it this month!

Re-design or not to re-design? Well, don’t break what works! However, innovation and progress are essential parts of every successful company. This is our second biggest change on the client section. I can’t wait to see the clients feedback

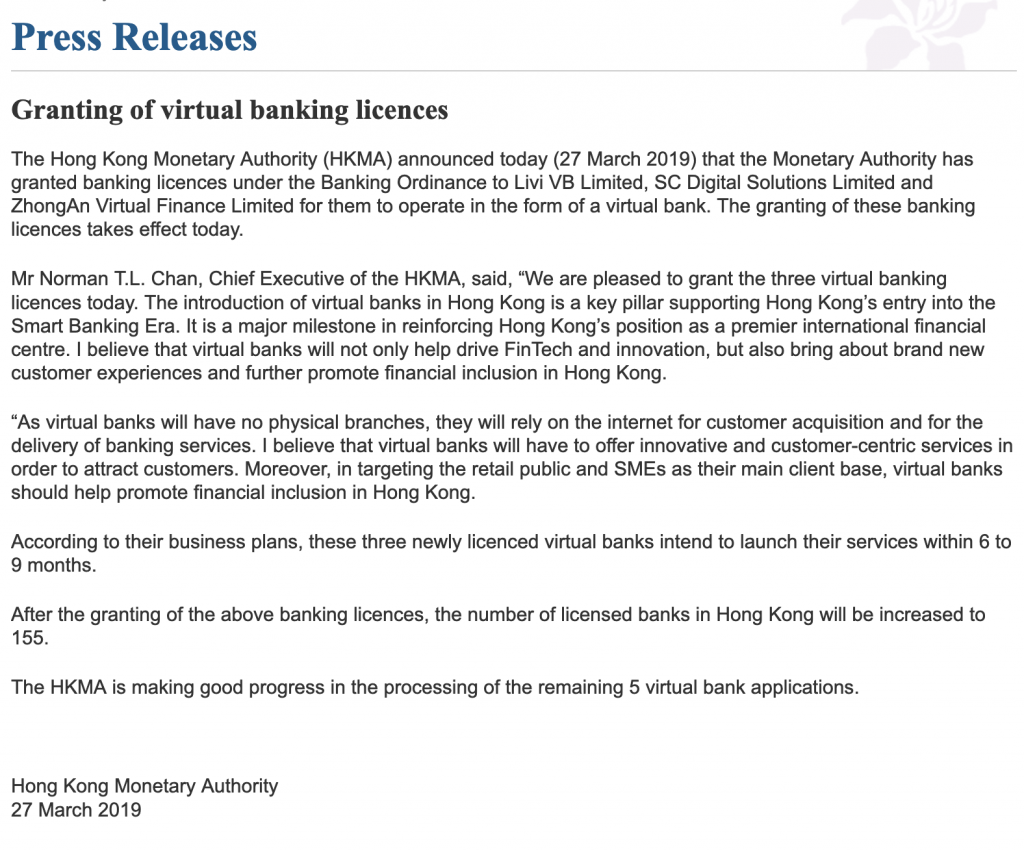

The Rise of Digital Banking

Digital banks on rising. Users have increased from 26% to 51% between 2012 and 2017 in the US. This trend indicates that many consumers are interacting with financial institutions through digital means, including desktops, laptops, tablets

The (HKMA) Monetary Authority has granted banking licences under the Banking Ordinance to Livi VB Limited, SC Digital Solutions Limited and ZhongAn Virtual Finance Limited for them to operate in the form of a virtual bank.

Since the Hong Kong banking was quite tragical, it would be great opportunity for Digital Nomands and for all online people out there to register Hong Kong company and set up a digital bank account with local banks.

Nevada or California – Where to Locate my business

In the US, we have several types of taxes, federal, state tax, plus sales tax and local taxes. Federal tax is the same for each state, you pay taxes directly to the IRS. C-corporation tax used to be 35%, after the administration has released the new tax code, C-corporation tax reduced to 21%. This is to incorporate companies in the U.S.

Every state has different tax provisions and different taxation laws, primarily the state income tax and sales tax.

Some states, such as Oregon, have no State Sales Tax. Florida doesn’t have an income tax for a natural person and S-corporation. C-corporations must pay corporate taxes. California has personal tax up to 12.3% and C-Corporation taxes to 8.84%. You also need to be careful with county and city tax or district tax. This might be the case for San Francisco or Sacramento.

Nevada doesn’t have an income tax for both persons and corporations (not mentioning LLCs as LLCs are taxed on a personal level and being a LLCs are pass-through entity). In that case there is a commerce tax for companies with an income exceeding $4,000,000.

Government Offices in Nevada are very friendly. They want to have more business so they don’t bother clients with questions or office inspections. This is very important for any business. Imagine you are starting a business, and instead of focusing on earning money, you might be distracted by state or local regulations. I’m not saying that it is not important to follow up with the government ordinance but I am making the point that it might keep you from focusing on your goal earning money. There is nothing worse than having unproductive days, especially As you are starting out. It might be a game changer.

If you operate in California, you should register your company in the state where you operate and file foreign qualification. E.g. if you are registered in Nevada and doing business in California, it is very important to comply with the regulations of each state therefore you need to register where you have employees, rent an office, or having a warehouse, etc.

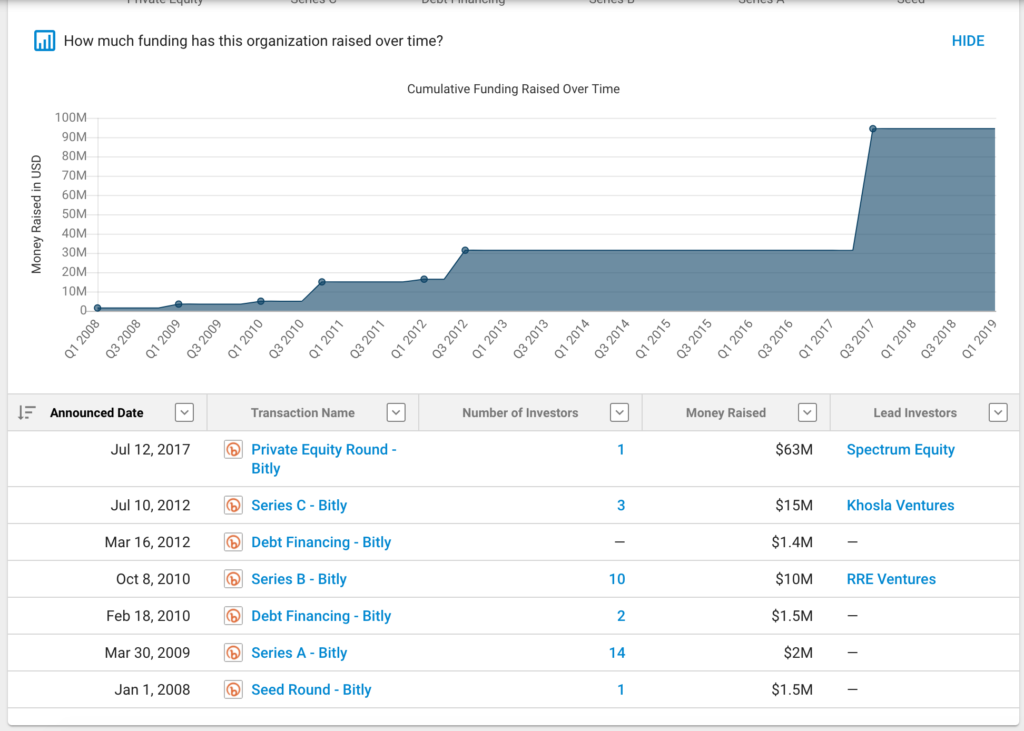

Bitly Funding Rounds

Everyone knows Bitly. It is a management link platform which shortens any long URL; you can try to input the URL into the empty column and get the shortest URL which can be posted on Social Media.

The service is very simple: You get rid of the annoyingly long URL without being necessarily aware that, while Bitly gives you the comfort of shortening your URL, you provide them with your data for their analytics.

As their business model matured, they came up with an idea that you can start using their analytics and measure the success of your shortened URL. Right on their website, they have a very useful tool to attract traffic of which a fraction will be their paying clients. My guess is that just 3% might be paying clients. This is their business model.

According to the CrunchBase The most interesting part is that they got a Seed Round of $1.5m on Jan 1, 2008, and the last financing Series C was on Jul 10, 2012, nearly five years after the initial seed investment. It is interesting that Series C, they had received Debt Financing of an undisclosed amount before Series C; this is the case only when you are short of money.

The company was acquired on Jul 12, 2017, nearly ten years since the launch of the first service. The company has received $94.4M which is very impressive!

I am thinking about how Eqvista can learn from the Bitly business model. I think we are in a similar position. Most of our clients want to issue shares to themselves. Bitly offers free URL shortening; Eqvista offers free share management software, but I see this is not the only similarity between these two companies. I presume that just a few of our clients will use any derivatives or securities such as a convertible note, KISS, SAFE, employees stocks or functions such as vesting, 409a valuation, waterfall, round modeling etc. All these features will be free of charge as well; however, we will also offer paid advanced services.

I guess we won’t raise as much money as Bitly, but it would be nice to have such a huge budget at the outset.