BCG Matrix in 2019

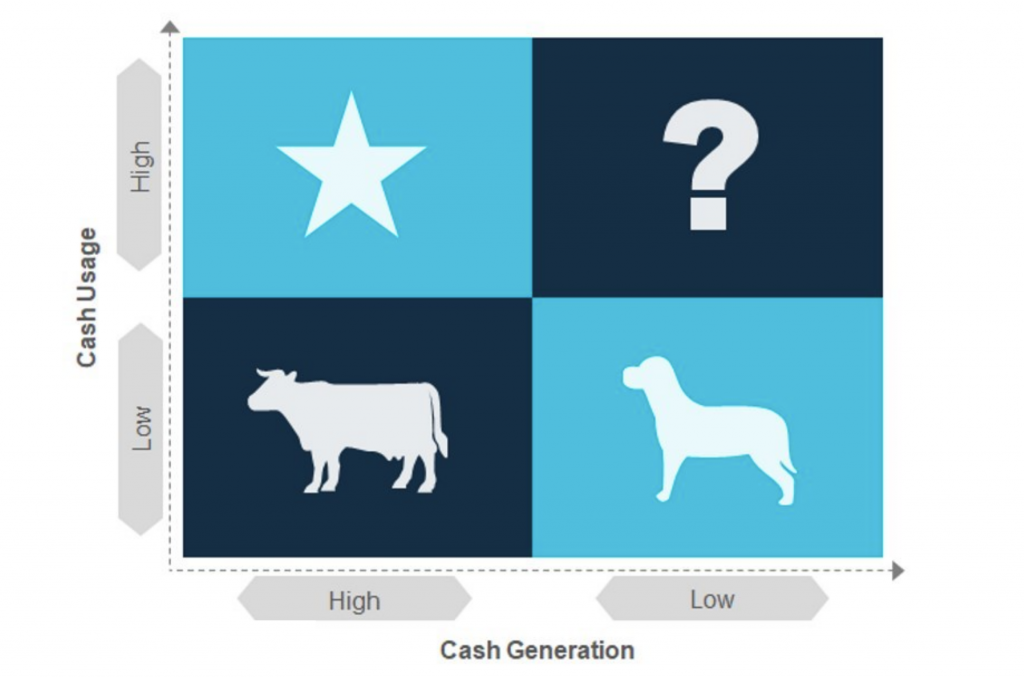

I guess everyone knows what it’s the BCG Matrix, right? For those who are not sure, it’s a matrix covering the product life cycle vs the usage of cash. You might read many explanations, but what about looking at them from the Silicon Valley perspective.

QUESTION MARK – it’s technically the early stage product and anything you launch and don’t have any idea if your products are successful or will thrive. Cash generation is very low, you have practically no clients and nobody is buying your product so your intention is to move to Star; you can technically keep up with the cash usage from the client who is generating the cash. This must happen very quickly as you can’t burn money.

DOG – this is the time to rethink if your venture makes sense or not. You keep burning money, it’s not as high as in “Question mark” stage, but it’s high enough to realize that your company or products are not successful. Rethink your strategy; get things right and start over again. It’s most difficult to shift to Star if the drive you had is gone and you need to refocus. You and your money dried up!

STAR – this is the most positive part of the entrepreneurship. You might get to the stage of your venture when you create something brilliant and unique! Everyone will love it! Your company generates plenty of cash so you can cover the cash usage and develop your company as you want. You are in tune with the growth of your company and you can do whatever you want, it is the most enjoyable part of your endeavor!

COW – this is the perpetuum mobile where the company keeps generating cash and you know that there is no extra cent you need to spend to keep that COW alive. The best way to prove COW stage, it’s to set up the company as “owner absentee” and have a manager to run it. This part is great when you run additional companies or are starting a new one. A company generating cash is a brilliant opportunity to start something new as you don’t need to put effort to generate cash.

If I look at today’s Silicon Valley companies none of them are pure COW, STAR, DOG or QUESTION MARK. Well, what I meant that today’s Silicon Valleys companies (the successful one, mid-size, and small size) are mostly burning more money that can be seen as STAR. It will still need cash to generate additional funds and on top of that, these companies receive additional capital to prevent them from falling to the other segments. These companies might be seen as SUPER-STAR – generating and spending cash plus raising extra money to keep growing and generating more funds, which will eventually be burned. This is today’s BCG Matrix in Silicon Valley. SUPER-STAR fundraising from investors as well as generating cash flow from clients is equal to debt! Nobody is interested in the cash COW!

And finally, why did I write this post? Well, we got contacted by one of the BCG representatives! I can’t be more excited, I don’t want to say which of our companies, but it’s proof that we do “something” right! If the deal will not go through, the fact that we have been contacted by one of the most prestigious companies in the world speaks for itself! I remember the day when my teacher of economics taught us about this matrix and now we have the chance to work with this brilliant company.

I have the feeling that I need to jump on the plane and talk to them. I just love these guys! They have been my STAR and COW all my life!