Tech Companies Merger and Acquisition data

I’m thinking of setting up a private equity fund focusing on Tech companies. The most important part of the fund is the data mining.

If you invest in publicly listed companies, it is very simple to look up the data and do benchmark analysis, read the Company Financials, the 10-K (is an annual report required by the U.S. Securities and Exchange Commission (SEC)), compare the data with the competition, see the trend chart and any hard data which are available to all of us who are willing to spend some time on research. However, there is not so much data for private companies?

It’s very hard to get all data from the owners of any company. Well, I guess I’m getting ahead of myself, as I should start with very basic search.

Here is the way to start any private equity company. It can also apply to any Venture Capital company focusing on A round funding.

First, you need to choose the industry you are entering. It should be something you are familiar with or you want to learn. I would suggest to look at the marco data.

Second,and most importantly, you need to look at the business nature of the company, what type of business they operate in.

Third, Data and Data again, this is the key to any decision-making. You try to make decisions based on the risk evaluation versus gain. It is well known that high risk should receive high profit and vice versa;as opposed to low profit low gain for you as the investor.

Fourth, who is behind the organization. Are the founders top stars in the industry ? Are they skilled to build up solid and profitable company?

Fifth, company accounting data; this is the most difficult part to analyze. If you are lucky enough to get company accounts without any optimization, you might have a nice understanding of how the company operates and if the company is profitable or not. The accounting must be very simple, otherwise the acquisition might be very risky since misleading accounting is the pitfall for any acquisition.

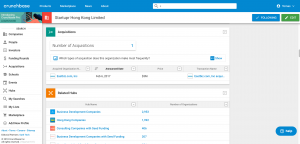

Crunchbase pro should unveil the first to forth point, and based on this data, I should be able to see any potential acquisition and hence be able ask founders for their financials.