Startupr has been granted TCSP license

We are so happy here at Startupr. Our company has been granted the Registry for Trust and Company Service Providers (TCSP). This is a very important license for operating the Company Secretary services in Hong Kong SAR.

We had been registered as Registered Agent #1652; however, since the introduction of the New Companies Ordinance (Cap. 622), a Company Secretary must operate under this section as a regulated body.

The Hong Kong government came up with an idea to professionalize more business and have provided the necessary guidelines.

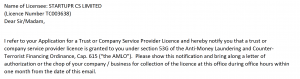

Here is the announcement we have received:

Registry for Trust and Company Service Providers is a regulatory body issuing and supervising the licensing. You can search for our license here.

Startupr’s TCSP license number is #3638; you can find our license at the Regulatory website. This is milestone for us because we have proven that our Company Secretary practice complies with the Regulatory framework. The License has been granted for Startupr CS Limited.

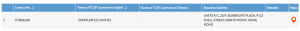

Here is our search result as listed by the Regulatory body, available for you to verify:

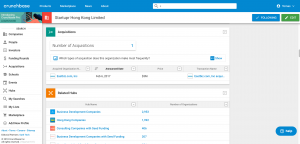

Tech Companies Merger and Acquisition data

I’m thinking of setting up a private equity fund focusing on Tech companies. The most important part of the fund is the data mining.

If you invest in publicly listed companies, it is very simple to look up the data and do benchmark analysis, read the Company Financials, the 10-K (is an annual report required by the U.S. Securities and Exchange Commission (SEC)), compare the data with the competition, see the trend chart and any hard data which are available to all of us who are willing to spend some time on research. However, there is not so much data for private companies?

It’s very hard to get all data from the owners of any company. Well, I guess I’m getting ahead of myself, as I should start with very basic search.

Here is the way to start any private equity company. It can also apply to any Venture Capital company focusing on A round funding.

First, you need to choose the industry you are entering. It should be something you are familiar with or you want to learn. I would suggest to look at the marco data.

Second,and most importantly, you need to look at the business nature of the company, what type of business they operate in.

Third, Data and Data again, this is the key to any decision-making. You try to make decisions based on the risk evaluation versus gain. It is well known that high risk should receive high profit and vice versa;as opposed to low profit low gain for you as the investor.

Fourth, who is behind the organization. Are the founders top stars in the industry ? Are they skilled to build up solid and profitable company?

Fifth, company accounting data; this is the most difficult part to analyze. If you are lucky enough to get company accounts without any optimization, you might have a nice understanding of how the company operates and if the company is profitable or not. The accounting must be very simple, otherwise the acquisition might be very risky since misleading accounting is the pitfall for any acquisition.

Crunchbase pro should unveil the first to forth point, and based on this data, I should be able to see any potential acquisition and hence be able ask founders for their financials.

Setting up your company shares structure

If you are just in the beginning of a company formation and planning on distributing shares among shareholders, you should have a strategy and get every preparitorial aspect in line.

Uncertified shares

You should definitely pass a Resolution of Directors on issuing uncertified shares. I’m a big fan of this. You do not need to keep paper (physical) shares and can issue electronic shares.

Par Value

If you set up a company, you need to decide what would be the value of your shares. Par Value is not a market price or accounting price as you have not yet started the business; therefore you need to set a value of the shares before you issue them. Par Value is the lowest amount for which a share of stock can be sold by the company. Most entrepreneurs keep the value of the share as low as possible in order not to pay high taxes. We recommend keeping the Par Value as low as $.0001, in this way you can pay far less for Franchise Tax. If you decide to have higher Par Value, your future employees will have to pay more for the shares. There is no reason to have higher Par Value share as this is the beginning and you try to minimize any financial burdens.

Many of our startups set up the price as low as $.0001. If you decide to set up an Incentive Plan for your employees, you will have to set up the share price prior to incorporation.

Authorized shares

10,000,000 Authorized Shares is the number for any startup planning on raising money from investors or having an Incentive plan for employees.

Before we start going deeper into this subject, please remember that the Franchise Tax might be one of the biggest surprises if you set up your Par Value high and multiply it by the authorized shares, this might trigger a higher Franchise Fax to be paid to the State of Delaware.

First of all, what are Authorized Shares? Authorized Shares are total shares which have been approved by the founder(s) prior to incorporating a company. It’s like approving a budget for how much money you can spend on a particular project. Once you have that number, you know how many shares you have that can be distributed among founders, employees, third parties (lawyers, advisors, consultants, accountants, etc.) or investors. You can also keep all shares for yourself; however, this is not the classical founding model here in Silicon Valley.

From the technical point of view, before you set up your company, you need to know the number of shares you will authorize. This is a must. The Shareholders Resolution will stipulate how many shares are going to be authorized. Once you authorize any shares, that is your company stock of shares. If you have authorized 10,000,000 shares, you can issue them to yourself, employees, third-parties or investors.

Now, you can issue shares and prepare Classes Of Shares

So how do you calculate the percentage of shareholders? If you authorize shares, it doesn’t mean that you have allotted them. You calculate the share percentage just on the basis of issued shares.

For example

You have authorized 10,000,000 shares

You issue 5,000,000 shares which are regarded as 100% of the all issued shares, and 2 founders keep 60% of shares in the company (3,000,000 I&II Founder Shares / 5,000,000 total issued shares)

Issued:

- 1,500,000 shares to I Founder (30% ownership)

- 1,500,000 shares to II Founder (30% ownership)

- 500,000 shares issued to employees (10% ownership)

- 1,500,000 shares issued to Investor (30% ownership)

You can issue more shares; however, please be reminded that you might end up paying a higher Franchise Tax. In the case of the Delaware company, you need to keep in mind how that will affect your tax bill. You can check this out on the website of State of – the Delaware Franchise Tax Calculator.

What happens with Unissued Shares? Well, there is nothing wrong if you don’t use up all company shares, you can keep them for future employees or investors. You are not required to issue all of them. Authorized Shares don’t vanish or expire.

Class of Shares

As you have authorized shares, you know that 3,000,000 shares are already issued to investors. However, you will need to also issue shares for your employees.

It is like filling out a basket with Eggs: You need to understand the size of the basket. If you authorize 10,000,000 shares, you should be able to reserve 1,500,000 shares for your employees. You might also give a name to these shares such as “Stars Program.” So now you know that 1,500,000 shares are untouchable, waiting for the employees.

Here is a perfect example, Employees Incentive Plan.

This is the most important part of any Tech-Startup. As there is a lack of capital in any startup, you might be offering equity to the employees in the form of bonuses or employees compensation. We call it Employees Incentive Plan. Every company understands the attraction of top talent, and this might be the way of how you can attract top people for your company and compensate them while at the same time bootstrapping.

If you raise any funds, you might call that class of shares the Seed Round. A Round is mostly referred to as Venture Capital Investment Class Of Shares.

You might also think of naming another class of shares, third-party providers “Rewards.” If you are running a low-cost startup, some of the third party providers might accept compensation in equity. Lawyers or any Consultants might accept company equity as part of their pay and work with you in this way.

Certified Shares vs. Uncertified Shares

You might keep issuing the Certified Shares which are far more complicated rather than issuing e-shares.

or you can switch to a simple solution (e-shares which substitues the old fashion way of certified shares).

Many private company startups are issuing their stock digitally rather than on paper; such stock certificates also known as certified shares.

Any Corporation can issue certified or uncertified shares.

Certified shares are shares which are in paper form.

Uncertified shares are shares which are issued digitally. They don’t have any tangible form. This is what I like the most, you can just issue your shares by yourself or for co-founders by recording them on an excel sheet and sharing this information with them. Every time you issue new shares, you simply add a new row and the description of the new owner of these digital shares. Please, remember to call them digital shares.

Before you decide to issue any digital shares (uncertified shares), make sure that your state operates under this special regime and recognises this type of share. Please, be reminded that every corporation must prepare a resolution of directors or minutes of meetings to enable your company to keep a record of digital shares.

If you want to issue uncertified shares, make sure that you have just one Capitalization Table (ledger record) in order to keep record of all shares activities.

If you’re a small entity up to a few founders, you can simply use a Google spreadsheet to keep as your records of your company stocks.

If the company has already issued certified shares (paper shares), you will have to “surrender” them and issue new ones. I would suggest that you seek advice from your lawyer. “Surrendering” shares means that you return them back to the company and then you can exchange them for digital shares. The process might be difficult depending on the company structure. If you don’t want to make this too difficult, you can just keep both type of shares, and start issuing new shares in case you have decided to switch to more recent and simpler modern and easier way of keeping a record of your company shares.

An additional benefit might be that you don’t have to contact your lawyer or transfer agent to issue new shares, you can just do it yourself. The general ledger or captable is actually the official record of your either company shares structure or company shares.

Why is it so important to work on many projects at the same time

I have always been a big fan of long working hours, managing many things at the same time. As a successful entrepreneur one must not only be able to concentrate one-hundred percent at all times but also be able to switch seamlessly from one project to any of the others! I’m currently managing several companies at the same time. Each company has its own manager which which is essential, of course, since I do a lot of business development so it is rather challenging to make sure that each company is progressing.

The chance to be successful is very limited, but the more you fail, the more experience you get. However, you should fail only as much as you can afford to. If you work on several projects, you are more likely to get lucky and be successful. This is the reason why you should be working on more than just one project or one company.

When I moved to Hong Kong, I was running several projects and just one got very successful. It was a company providing incorporation services – Startupr.

I know that it’s difficult to manage several businesses or projects, but your chance to be successful increases. I would suggest you learn quickly, starting as many as possible in order to test them in the market. You should not waste your time with meetings or with traveling to an office for the first few months. You can save loads of time by avoiding such unnecessary activities, and focus on what really matters. This is a good example of how you can save around 1.5 working days per week. If you travel to work for 1.5 hour every day and you have meetings for one hour four times a week, you already lose of 10.5 hours precious work time. This is just one example of how to save time. I would suggest to be constantly on the alert for time saving opportunities to increase efficiency. I cannot stress enough how important it is for making your company happen.There will be times when one of your projects or companies will be suffering and that is why you have another project or company to substitute for the downsides.

If you start being super efficient, you increase your chances of working on several companies. Once you develop essential skills and the client base is growing, you can hire employees who can manage your company and you will be able to focus on additional projects. Again, it’s very important that you maintain ultimate efficiency. Your companies must have the direction and a clear vision of where they are going to be within a few years. This is another aspect of managing several companies successfully. It should be constant work and permanent pressure. You need to make sure that you can measure results so you know whether your work technique is heading in the right direction.

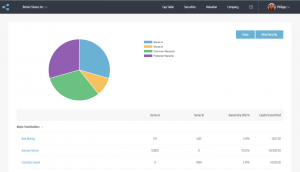

Incparadise offers CapTable

I can’t wait to launch our new service. We will offer CapTable free of charge.Incparadise and Eqvista will provide this service.

Captable is shares management tool helping startups with recording shares activities. Its a list of companies securities. You should be able to see who owns what. Further, it captures ownership (founders, employees, investors, third party providers), value of equity in each financing round or equity awards to your employess and equity dilution.

You will be able:

- to issue/authorize/allot shares – common or preferred shares

- to record convertible note

- to record employees equity

- Investment rounds – seeds & investment types: A,B,C,…

- To record warrants

Setting up a Delaware company – Consider income tax & franchise tax

Recently, we have been recently setting up two companies in Delaware. We will operate shares management platform which will help startups in managing their company shares. If you are in a position of setting up a company and you will be in need of CapTable (Capitalization Table – here is short description of our new project) which helps you to distribute shares to employees, investors (VC or Angel investors) or third party providers.

We have chosen Delaware as it is the most common practice because it has favorable law structure. You can enjoy many benefits. You will also be required to incorporate in Delaware if you will ask for investment from Venture Capital firms.

There is much confusion about Delaware corporate taxes. Here is a short explanation of how to understand the process.

Before you set up your company:

- State Incorporation Fees $89 (also known as filing fee)

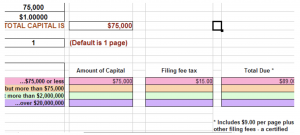

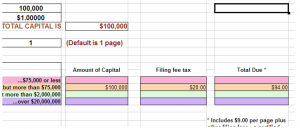

If the capital is less than $75,000 then only the $89 Article filing fee is due.

Example: this is for $75000 capital (75000 shares x $1.00 par value=$75000 capital)

If the capital is more than $75,000 then there would be an additional fee…

Example: If the capital is $100,000 (100,000 shares x $1.00 par value = $100,000 capital) the Articles filing fee would be $94.00 (not $89.00)

So the Article filing fee depends on the total Capital.

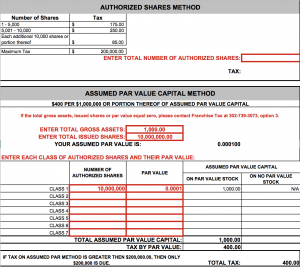

- Franchise tax – never less than $175 (Assumed Par Value Capital Method)

Before you set up any company, please make sure that your shares have value per share e.g. 1share = 0.0001 otherwise you will have to file taxes based on the Authorized Shares Method.

Franchise tax might be one of the biggest burdens for any incorporating startup. I would suggest for you to issue 10,000,000 shares, each share priced at 0.0001$ (10,000,000 shares x 0.0001$ per share = $1,000) In fact, a fraction of a cent is the commonly recommended amount. Keeping par value low means that stock can be purchased affordably in early stages when the company is worth virtually nothing. You must also mention the total gross assets. We started at $1,000 as this might reflect the incorporation fees of the company and therefore this covers the total cost and value.

The reasons to go with 10,000,000 shares:

- You would like to issue 3,500,000 among the founders

- 3,500,000 shares are booked for Venture Capital firms

- 3,000,000 shares are booked for employees and third party providers (in case you want to award shares to lawyers or third party providers)

Here is the franchise tax calculator.

Annual taxes & fees:

- Annual Report $50

- The Franchise Tax for a corporation is due by March 1 of every year.

- Delaware income tax:

- If you conduct business in Delaware, you pay 8.7%

- If you do not conduct business in Delaware you pay 0%

Federal income tax:

- You pay flat 21% corporate tax

Regulation D, Rule 506(c) Blind Pool Offering – Brilliant option of raising funds

Regulation D, Rule 506(c) Blind Pool Offering is a brilliant option to raise a fund in the USA.

Why would I need to register a fund? Well, it’s a simple answer. The financial sector is heavily regulated, and you cannot start raising money without proper registration of your fund with a regulator. If you’re raising money from a few investors, you would need to contact a lawyer and have a set up just a basic Incorporation and prepare Articles of Association or Shareholders Agreement. If you are pooling more money for the further investment, you should register your company with SEC. There are a few different options to explore 506(b) or 506(c).

I would prefer to go with 506(c). Here are the reasons:

- Allows general solicitation and advertising in private placement offerings so long as sales are made only to accredited investors. You can advertise your fund (general solicitation) through online media.

- The fund is registered as the exempted fund.

Purpose of the private equity fund:

- Private equity (acquiring other companies).

- Venture Capital Fund.

- Property Investment.

When you set up your fund, you will need to prepare:

- Private Placement Memorandum

- Subscription Agreement

- Securities Notice Filings

- Formation of a Management entity and drafting its Operating Agreement

- Formation of a “Fund” entity and drafting its Operating Agreement

- Formation of a Single Purpose, Title-holding entity for your first project and drafting its Operating Agreement

- Marketing materials (flyers, postcards, website, etc.)

- Investment Summary

Filing with SEC, you will need to:

- Open EDGAR (EDGAR is the electronic filing system created by the Securities and Exchange Commission for corporate filings.) account with SEC.

- Submit Form D to SEC through EDGAR website.

- “State Blue Sky” notify the state securities agencies when a security has been sold to one or more or their residents and giving those states information and jurisdiction.

- Submit soliciting materials to SEC for their approval.

- Verify that the investors are accredited investors, which could include reviewing documentation, such as W-2s, tax returns, bank and brokerage statements, credit reports and the like.

Timing: The normal time-frame to complete an offering like the Blind Pool Offering is 60-90 days.

I wouldn’t suggest you get this done yourself. It’s heavy lifting. Hire a lawyer and use this article just as a checklist :).

How to overcome positive startup frustration

I’m launching a new business focusing on company valuation and managing shares. I might say that these new services are very close to our current business model where we offer company formation and auditing services; however, it is a totally new business model that requires completely new type of accounting structure with regard to auditing procedures.

We are contemplating procedures such IRC 409a valuation, ISO $100k limits, ASC 718, Rule 701, 83(b) election. Each of these regulations have certain rules and strategies about how to calculate them. If you’re completely new to this concept and are thinking to raise money for your startup I would suggest for you to familiarize yourself with all of these terms.

If you are launching a new business you need to go through several stages. I might also explain briefly the concept of “positive startup frustration”. We have many choices in our life; I have chosen to be an entrepreneur, and this is very advantageous as far as I’m the one who can decide what needs to be done rather than someone telling me what I should be doing. I’m very forward-looking though. Frustration comes from uncertainty when you have limited sources and need to make intuitive decisions every day about dozens of little things .

Here is my outlook on the most important part when I start any business.

Gathering of information – I guess this is the most important part that either leads to either success or fail. When I was starting any businesses I was either eager to study and learn it by myself or I hired people who would provide the part I didn’t know enough about.

Startupregistry.hk – I have learned everything with regards to company formation from the Hong Kong SAR Company Ordinance so we could advise our clients on all aspects of how to set up Hong Kong company.

Ardanas.cz – We also brew a beer. In this case, I outsourced this task and hired brewmaster, not having any knowledge in this speciality myself.

In order to focus on different parts of the business, you need to determine whether you can learn it by yourself or hire people to do it for you.There are too many elements to deal with so don’t be afraid that you miss something if you don’t know every small detail of the undertaking scope, because you can always excel in another aspect of the business.

Learning – Once you gather all information, you need to study every aspect of the business. This is the critical part of any startup and here is the option where you can outperform any competition. Some of the regulations processes and options change where the already established companies have no or little reason to innovate as far as they are profitable. This is your biggest advantage. The game at this point is different so you can come up with a completely new or innovative business model.

Startupregistry.hk – Back in 2011, Company Registry had launched an online company formation system and we were one of the first adopters. It is now 7 year later and the majority of company formation service providers still file company documents in paper form which works very well for our company.

Ardanas.cz – we had difficulties to import our Nopal powder and so did our competitors. However, we overcame this part and learned how to get it done. The result has been astonishing, there is no competition in this field because the process of importing it was so difficult that most of our competitors gave up.

Implementing – This is the execution; I think that this part can be very frustrating as you need to find out the right concept for you business. There are loads of trials and errors but this is the way you succeed. You have just a few trials and limited time. With poor execution you get lost in the process. The key is to first get things right and ready for your clients. If you have any product, you just make sure that you can have it tested very quickly by your clients. Make sure that your clients have immediate access to test it.

Startupregistry.hk – We got better in marketing and are promoting online company formations. We had some competition but we have since advanced in marketing. We were able to move quickly in this field because my business partner had experiences in the food industry.

Ardanas.cz – My partner was operating in the food industry for many years so we are able to have distributed our products very quickly.

Marketing – You need to do heavy lifting here. This is a never-ending job and you need to learn how to sell. I’m calling this as THE KEY to any rapid growth of any new business.

The biggest advantage is that as we are new in this industry; we strive to come up with totally new concepts and immediately harness the necessary energy. This is another very important part of any new business. It’s always more fun to start a new business rather than changing already established companies. It is not only fun but it is also a challenge to get things right.

Although this service industry has been completely new to me, we know that nothing comes easy, so we study intensively and strive hard to get things right.

So this is our process for a new business venture where we learn all these new terms and processes everytime we start a new one. Fortunately, we are in a perfect position. We have a team of professionals who handle all tasks.

How did I save money for my first business ?

When you are starting a new business you always have to have some advantage over your competition. Such as explain I am serial entrepreneur who has been on the cutting edge for sometime. Given my experience let me offer you several ways how to succeed. Here is a part of my life which is called “frying” and I can tell you it was loads of “frying” though :).

My first business venture started back in 2006 when I was still a student at Mendel University finishing my bachelor degree. There is a program called Work & Travel in the US. As a student you can get a 4-months working visa (J1), just enough to earn some money and get the opportunity to travel for a few weeks in the US and go back to Europe. My mates would usually choose to work and travel. I chose a different path and would rename the program Work & Work. The reason is very simple. I just worked over 100 days without a break. It would be just a normal shift to work, even 20 hours a day. I remember, there would be a week where I would spend 128 hours at work. This was probably the record for that restaurant. It was just madness, but fun at the same time.

All started back then when my friend Lubos would tell me his stories about a restaurant where the owners would just use all your potential and give you an opportunity to work as much as you could bear. The owners were and still are very hard working people and that’s what we all did. The restaurant had over 100 employees in the summer season. If you wanted to earn good money you would go there and work very hard! I was 17 and knew that this would the perfect way of saving money for my business plans. So I did. A few years later I would be on my way to Hampton Beach. It’s really a long time ago when I look at it from where I’m today. It has definitely been a long journey.

So I became chief cook and bottle washer :). A typical day would start at 4am. when the CISCO truck would deliver all supplies. There would be just two of us to unload the truck and it would take us about 2 hours to get it all done. We would have to take all of these products to storage store them in their respective pantry. The restaurant was big; it had 3 kitchens on 4 floors plus a pub which was underground. Sometimes as a guy who knows and is willing to do everything, I would move all over the floors in just one day, simply to cover for, or help, other cooks.

The first kitchen would be open at 6am. and we would serve just normal American breakfast, mainly eggs prepared in different ways. We would cook for hundreds of guests with just 4 staff. 9.30.am we would move to the downstairs kitchen to get ready for lunch. It was busy. Sometimes there were days where you wouldn’t even be able to go to the restroom as the mini printer on the shelf would keep spewing out orders. Lunch was usually available until 4pm when I would start ordering supplies for other days. This would involve me to run up and down several floors and check on our stocks or supplies. Then 6pm dinner started and the bar opened where we would serve mostly nachos; actually it would be hundreds of nachos. It was so busy that the printer would print 10-foot-long order lists and it would go on until 11pm. By the end of the day, we would have to make sure that every kitchen was clean, and dishwashers were busy and up to the elbow in hot water until everything was clean; this would usually last till 4am in the morning. I would stay just till 2am. This was my day back in summer of 2006-08 where we would work very hard to save money, to learn both discipline and mental control. I could have chosen to either spend my time doing nothing, or getting ready for my business carrier.

So this is me working hard and building for my future. I would usually spend 15 weeks, that x 112 hours (on average) and earn $13 per hour equals around $22,000 at that restaurant. This would usually be my summer job pay. I did 3 seasons in that restaurant and saved money for my future businesses which became very successful. I guess this was not bad for university kid.

Before you start any business, you either have enough money to quit your job right away and be 100% in your business or you work at night if you have a day time job.

I saved that money to start my nopal business.