Hong Kong as the best city to start a business

You might think that it is a joke. How can the most expensive city possibly let you bootstrap?

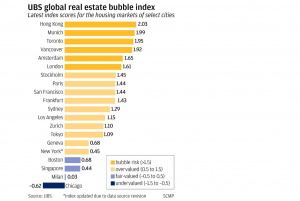

It is very simple. We call it taxes. :)When I moved to Hong Kong back in 2011, the prices started going up 10% every year until Hong Kong became the least affordable city to rent or buy property. Hong Kong housing leads as the most expensive city in the world.

Giving that fact, how can the city be pro-business? Well, it is very simple. Hong Kong has the most favorable tax system in the world. They have also introduced the $ 2,000,000 HKD tax break so if your company earns anything up to $ 2,000,000 HKD, you pay just 8.25 % (for the year of assessment 2018/19 onwards). It is 50% less than for previous years. Isn’t that amazing? So if you do business with the rest of the world you have the competitive advantage of paying fewer taxes compared to other countries where your competition pays likely 45% in taxes (this might be the case for some countries in the EU e.g. France, Italy, Spain, etc.)

Here is an example: if your company earns $ 3,500,000 HKD in 2018, you will end up paying as follows:

- 8.25% on assessable profits up to $2,000,000 HKD; ( 0.0825 x $2,000,000 HKD)

- 16.5% on any part of assessable profits over $2,000,000 HKD ( 0.0165 x $1,500,000 HKD)

So basically what you save on taxes, you can invest back to the business, hire more people, or raise salaries for your employees. You can also rent a better place. The rent in Hong Kong is super expensive but again it is offset by lower taxes which, even though you pay more for rent, makes it affordable.

Or you can do it the way I did it. I moved to Hong Kong back in 2011. Before I moved to the city to set up Startupr I was studying the Hong Kong company ordinance and the Inland Revenue Department taxation system. It took me nearly 5 months to understand the whole process and have a clear understanding of how the system works. This was an important part of the relocation as I was immediately ready to proceed with my business venture.

Before you move to any place you should look for a location. It should be low cost; you can share the house or have just a little studio where you pay just very, very little. I have seen people moving to expensive apartments, thinking that hey can manage it. They would be paying as much as 70% of their monthly income. My target was to pay as little as possible so that I would not even notice that I am paying a rent. This may seem as a brutal tactic; however, this is a must if you want to successfully run your own business in a foreign country. You are a complete stranger, so you need to be more careful than locals. When I look at the people who rented crazily expensive apartments, they either returned home to stay with their parents (even though they may be 30+) or they were forced to downgrade in job quality because they didn’t find the same job level as they had before. It is very tough at the beginning. I was paranoid about having to return to my home country, knowing that I had wasted time and energy uselessly.

I still keep the same house today as it is very convenient for me to return to the place I have known for many years. It feels like going home because you know the people and the area. Six years is long enough to feel at home.

Interactive Guidelines

If you are building any software which requires certain know-how, it is also very important that you prepare guidelines which will navigate your clients through the platform.

There is just a little to be done if the platform is just a one-time set up; e.g. stripe.com is a perfect example. Your IT team plugs Stripe APP to your platform and you make sure that you have the correct bank account number and routing number on the backend so you receive the payment to your bank account. There is no big science in implementing the payment processor. However, if you use QuickBooks, you must have specific knowledge to keep your books in order. Sometimes it is better to hire an accountant to get it done for you because it is too time-consuming and somebody would have to take it over from you anyway. QuickBooks has do-it-yourself guidelines, however, the process is too involved to waste your precious time on it.

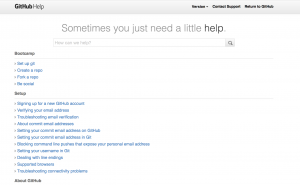

Another great example is GitHub:

They have great guidelines which can help you understand their platform, but, again, this is for IT engineers who are using the platform often.

Here at Eqvista, we want to come up with an interactive solution for you which would help you to guide yours through the system as you do not need to fill out your captable details on an everyday basis. Lawyers, consultants, and auditors may charge you $400-$600 per hour or $5,000< flat fee for setting up your CapTable. Our guide will give you the strength to do the same job what the third party provider would charge you.

For example, let’s say that you want to grant shares to your employees. First, you need to create a special class of shares, such as “My Stars Employees Class”, usually between 10% – 15% of the authorized shares. Then you have terms, something like a cliff, vesting schedule (vested vs. unvested shares), 409a valuation and strike price. What does “4 years vesting with 1-year cliff” mean? Do I reserve Preferred Stocks or Common Stock? What is the difference between the 409a valuation and its post-money investment valuation? These are all questions you as founder might have. It might be difficult to understand all these terms, plus how they are used in a more practical way. It is something else you will need to learn.

So the plan is supposed to explain the theory and then guide you through the process of practical understanding – how to convert the theory to its practice.

I have covered the difference between authorized shares vs issued shares in here. Now, imagine that you have star employees and you want to award them, right? There are processes you need to follow. First, you need to make sure, that you reserve, let say, 10% of authorized shares for your employees, and you name this class of shares “My stars employees”. You will make sure that you block off these shares to not use for other purposes.

Before you grant any shares to your employees, you need to get the $$$ valuation done. For tax purposes, you need to get the valuation from an appraisal company in order to know how much each one receives in value. Valuation for the investors for Preferred Shares it is a different process. Let’s put this aside and focus on the employees first. You receive your 409a valuation report that tells you that the value per share is $10, so you can issue, for example, 1000 shares to your first employee which will allocate to him/her $10,000 equity in the company.

There are also other terms you need to know. A typical options vesting package spans four years with a one year cliff, and the vesting period might be set for 4 years. You usually set the cliff period as a one-year cliff which means that an employee will not receive any vested shares until the first anniversary of his/her start date. An Employee gets the first shares after one year. Then, beginning with the anniversary date of the employment he/she receives the shares for the next 4 years on a quarterly schedule.

In order to have your capitalization table complied with the captable standard, this is one of the examples of how I would describe the process of all the procedures you need to know.

Our platform will have direct links from each window or pop-up window so you won’t get lost.

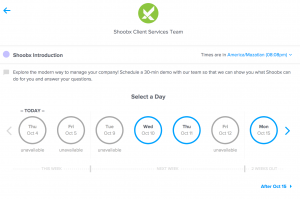

Demo account – set up a call or let client to explore your app right away?

Have you realized that most of the online companies offer free tools or limited access to their platform? I am a big fan of these product promotions, however, what really irritates me it is when you try to get a demo account or limited access and you are asked for scheduling a demo call where they have control over showing you around. I understand that they want to convince any client to use their platform and that chance increases if they talk to you in person, but it might also discourage a client to pursue further contact. This is in my case when I have an option to use the demo or limited account, I would expect to get access immediately in order to make a decision whether or not to use the app. Perhaps, if I am not convinced by their services they offer or have any doubts, I would like to have the option for scheduling a call with the company representative.

This is actually what we want to achieve in eqvista.com where you will have a free access on our platform and complete with the manual of how to use it. If you are not sure where to click or how to use any tool, we are ready to assist you by either making a call or online chat without any strings attached. We feel good about this approach.

As the calls or appointments feel like a bottleneck to potential customers in their decision to use a platform, this might be one of the reasons why clients prefer not to use it. It can even appear that such a company is pushing their product before allowing you to test it, and instead try to persuade you during the introductory meeting or phone call.

Another thing that I do not like about the limited access is that companies offer and share a solution but withdraw completion unless you commit yourself to purchase their product. Again, I understand that some functions must be paid otherwise the company won’t be able to earn any money, but the line should be drawn clearly so you know at the outset that there might be either a catch or a perfect tool to use. We want to offer you a balance where you would be able to use our platform without spending if you are a non-frequent user; however, if you decide to use our platform for heavy operations, we will offer advanced services for which you will be charged.

What do you think, is it a good idea letting our clients try our platform right away or would you like to have a call with us before login?

Seed Fund Feature – How do we get traffic to eqvista.com?

When you start your company, an idea is all you have. However, Ideas have no value. The key is the execution. When you start looking for investment, you need to have a $$$ amount in your mind. The amount should reflect how much money and what equity you should give up in an exchange of the invested money.

We have current clients at startupr.com and incparadise.com, and expect to get clients from our existing client base for a shares management platform which is necessary for every company. There also has be some additional way of getting some extra traffic. A free tool might be one of the ways of how to get more clients on our platform. If your company is just and an idea the tool helps any entrepreneur with their company shares.

The free tool should help entrepreneurs to valuate the company before it starts its company and has just an idea. That method should help to come up with the reasonable value which can be presented to an investor. I like the several methods which are the most common; Berkus Method, Scorecard Valuation Method and Running Costs and 20% Growth Method.

Clients might be interested to get valuation for their pre-funded startup and compare it with other startups on the CrunchBase.com platform (CB). CB offers data through their Pro CB account. We have access to it. Now you will be able to use 3 method valuations based on your data entry. You will also get comparison values with a similar company in your industry; we have access to around 50,000 companies in any Seed Round investment. So you will get a median and average of the amount invested into a Startup similar to yours. You will also know when the company gets funding – average and median.

How does our new function work?

This is the way it will work:

- As a 1st step, You will fill out the form: company name, year funded, biz nature (authentic with the scale on CB), name of the founder, contact information,

- You will fill out login and all data

- You pass the 3 valuation method; Berkus Method, Scorecard Valuation Method and Running Costs and 20% Growth Method

- API will put out data from CrunchBase

- Statistics of the Seed Funding, amount in average, time of founding the company and Investment Seed Fund

- All your data will be saved in our Platform

- URL will be: eqvista.com/val/company-name

- We will display data of the company

- 3 valuation methods

- Comparable company in your business sector

Functionality:

- No money Raised – (under the CB conditions: no seed, no A,B,C Seed funding – we will pull out data from CB platform and ask interested clients to fill the data, so they can get the type of investment made and compare them with CB data.

This will be saved in the clients account and possibly shared with investors/shareholders/third parties

- Client will fill out current company value and will be able to compare it with the current company on the CB platform

- Compare your company value with competitors or who has already raised funds:

- Average and median funding in the Seed Round

Valuation Method: Running Costs and 20% Margin

Seed investors always invest in people and ideas. Since ideas are fleeting, the most important is the execution. Most of the Venture capital firms invest in people who execute and know how to get the product done and into the market. Seed Investment refers to a series of related investments which 10 or fewer investors “seed” a new venture with anywhere from $50,000 to $2 million. This invested money is often used to support initial market research, plus early product development.

Just a little technical advice:it doesn’t look good if you are raising pre-seed money and have nothing but an idea and a team (pre-seed is usually $200,000 – $500,000). This misconception discourages investors from participating in pre-seed opportunities; it is better if you come up with a concept to get some money from your closest source. Once you have something to demonstrate, such as product, team, and potential clients, it is much better to ask for seed money, even if your company has zero revenue.

For this reason, I came up with a method which might fit your need when you will be asking for any seed investment. It is very simple and logical. The most important part of any startup is to plan your budget for at least 18 months. Your runway may be as long as 18 months and you need to make sure that you will receive an investment covering this period. For example, our new product in Eqvista was completed within 7 months so we have 11 months to find clients and some market share. So it is doable to get your product done within 6-7 months.

Of second importance is the valuation e.g. how big your team should be. If you know that you will need 6 -7 months to launch your product, calculate how many people you need. For example:

Your Team ($540,000 USD):

- 3 Junior IT Developers $ 60,000 USD (per each)

- 2 Senior ID developer $100,000 USD (per each)

- 1 Senior Online marketing developer $80,000

- You as the owner of the company $80,000 (never pay yourself more than the average)

Office running costs (rent, phone, internet, utilities) = $ 108,000 USD

Total Costs: ($540,000+$108,000) x 1.5 years (18 months) = $ 972,000 USD

Depending on valuation methods, you can value your product and idea where they become part of the investment; Berkus Method gives you the opportunity to come up with Sound Idea or Prototype. These 2 elements become part of the valuation.

Scorecard Value Method counts in the Product/Technology and Size of the Opportunity.

In our method, you use the rule of 20% where that would be the margin if you sell your product. Let us presume that a healthy margin is 20%. So if you work on any project or product and you expect to sell it, your added value should be marked up by 20%. This twenty percent is basically the extra value you bring to your project. Again, this is the statement you are able to rationalize if any investor would question why 20%. We might look at this 20% as expected profit. However, 20% represents the Sound Idea (basic value, product risk), Prototype (reduces technology risk) in Berkus Method or Product/Technology, Size of Opportunity in Scorecard Valuation Method. These 2 models are quite subjective. I believe that this will help you to get your feet on the ground once you get challenged by any investor.

Total (with your 20% margin) = $ 972,000 USD x 1.2 = $ 1,166,400 USD

I am convinced that this is a sound approach, and you can always uphold the reason why your valuation is set as it is. As stated above, It has a reason.

Now the question is how much equity you should give up.

For a $1M seed round:

A VC firm will look to get 10%-20%

A group of angels/seed will look to get 15-25%.

However, I really like the other valuation methods (Berkus Methods, Scorecard Valuation Method), but, I feel that it would be very difficult to defend the numbers if you are asked why you think that your idea is worth $500,000. It is much better to be able to demonstrate how much money you need to build up a team and cover running costs. The 20% margin is also a great way to explain that this is the profit you would expect if you sell that project after 18 months. A 20% margin is a healthy markup for you in exchange for your experience and your knowledge.

Startups vs failures

Startupr was incorporated in 2011 which is already 7 years ago. We help to start 400 – 600 companies every year. So if you take the average, we help to start around 500 new companies every year. We recently did some calculations and found out that most of the companies are basically not renewing due to their failures. This is quite common for startups. I befriended a few of our clients and became aware of how the business some of them don’t go as planned. This is quite normal; not everyone can become a successful entrepreneur.

From our statistics in Startupr:

- 1st year since incorporation 50% failure

- 2nd year since incorporation 75% failure

- 3rd year 80% failure

- 4th year is 90% failure

- 5th year is the “I made it year” 10% of business survive

I have also looked at the current situation in Incparadise and have found out that the statistics are a little better by 5-10% in every category. This is just a real-life situation.

As I have mentioned earlier, I know a few clients, so I know there are many reasons. I have been raised in Europe in a business family, and grew up in Hong Kong, became an entrepreneur and I am now running businesses in the US, Hong Kong, and Europe. I can say that the characteristic of failures is always the same. I think that most of the failures are caused by lack of founders’ hard work and enthusiasm. I know that you would think that everyone works hard, I agree however that there is hard work and really hard work. Every entrepreneur insists that they work very hard, however, some of them don’t really know what it means to dig in and get things done.

Another issue is luck. I know that luck is very difficult to measure that, but I can see the same smart people get hugely successful, and other people end up just mediocre. Why is that? Well, again it is sometimes very hard to explain but you really need to have the gift, or we can call it luck, to succeed. I am sure that success might be 70% of hard work but you also need luck which can be 30% of the overall picture.

Eqvista – Seed Fund Feature

How do we get traffic to eqvista.com?

When you start your company, an idea is all you have. However, Ideas have no value. The key is the execution. When you start looking for investment, you need to have a $$$ amount in your mind. The amount should reflect how much money and what equity you should give up in an exchange of the invested money.

We have current clients at startupr.com and incparadise.com, and expect to get clients from our existing client base for a shares management platform which is necessary for every company. There also has be some additional way of getting some extra traffic. A free tool might be one of the ways of how to get more clients on our platform. If your company is just and an idea the tool helps any entrepreneur with their company shares.

The free tool should help entrepreneurs to valuate the company before it starts its company and has just an idea. That method should help to come up with the reasonable value which can be presented to an investor. I like the several methods which are the most common; Berkus Method, Scorecard Valuation Method and Running Costs and 20% Growth Method.

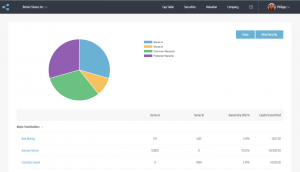

Clients might be interested to get valuation for their pre-funded startup and compare it with other startups on the CrunchBase.com platform (CB). CB offers data through their Pro CB account. We have access to it. Now you will be able to use 3 method valuations based on your data entry. You will also get comparison values with a similar company in your industry; we have access to around 50,000 companies in any Seed Round investment. So you will get a median and average of the amount invested into a Startup similar to yours. You will also know when the company gets funding – average and median.

How does our new function work?

This is the way it will work:

- As a 1st step, You will fill out the form: company name, year funded, biz nature (authentic with the scale on CB), name of the founder, contact information,

- You will fill out login and all data

- You pass the 3 valuation method; Berkus Method, Scorecard Valuation Method and Running Costs and 20% Growth Method

- API will put out data from CrunchBase

- Statistics of the Seed Funding, amount in average, time of founding the company and Investment Seed Fund

- All your data will be saved in our Platform

- URL will be: eqvista.com/val/company-name

- We will display data of the company

- 3 valuation methods

- Comparable company in your business sector

Functionality:

- No money Raised – (under the CB conditions: no seed, no A,B,C Seed funding – we will pull out data from CB platform and ask interested clients to fill the data, so they can get the type of investment made and compare them with CB data.

This will be saved in the clients account and possibly shared with investors/shareholders/third parties - Client will fill out current company value and will be able to compare it with the current company on the CB platform

- Compare your company value with competitors or who has already raised funds:

- Average and median funding in the Seed Round

Beginning of my entrepreneurship – I was paranoid!

When you move to completely new country, you feel that the only way to feel safe is to work. There are many distractions which might get in the way of your essential work duties – such as vacation, alcohol, ladies, hobbies – you wouldn’t believe but people like to have a fun just after their business starts, and they feel that the business is doing well but without stable income and with limited savings you must stay alert and constantly work to succeed!

I have been off and on outside of the Czech Republic since 2006. However, the permanent move was in 2007 when I would study at three different universities at the same time. There would be one week when I would have to leave my apartment on Tuesday morning, pass an exam at the Gebze Technical University, fly to Prague to change summer clothes for winter clothes and fly to Oulu (the University of Applied Science in Oulu), Finland, where I would have to take an exam on Thursday afternoon. I would also study at Mendel University at the same time. My habit was to keep it up and get it done. I would never be capable of being satisfied with 90% regardless of the complexity of my system; I would always do 100%.

This habit has shaped my skills that it enabled me to forge ahead even this if it meant to stay out of my comfort zone for many years. If I look back, I was without vacation for ten years! I was just running like crazy to make sure that I will not miss the boat.

When I moved to Hong Kong back in 2011, I was already experienced; however, all my previous money were invested in the Nopal business which we started back in 2008.

So I moved to Hong Kong, and there would be another period of my life when I would work very hard forge ahead five years without vacation or a single day off. I would be so afraid that I am not doing enough that I came up with unique formula:

Overtimes – 6 hours every working day – let say we usually have 225 working days in a year, times 6 hours a day = 1,350 extra hours per year

Paid Employee Holidays – 20 days times 15 hours = 300 hours – I would not take a single day off.

Weekends – there 52 weekends – 110 days in 52 weekends – I would work at least 10 hours every weekend. 110 days times 5 hours = 550 hours

Public Holidays – 10 days – 10 days times 15 hours = 150 hours (I would consider the public holiday as normal working day)

In this way, I spent extra 2,350 hours what I would have done compared to a regular schedule.

I did this practically from 2011 until 2015. Five years times 2350 hours extra per year = 11,750 extra hours/8 hours (normal working days has 8 hours) = 1,469 extra days. If we convert it to the working days considering 225 working days, I would work 6.6 extra years in this period 2011-2015.

This is how I achieved what I have built.

I would be very paranoid if I wouldn’t be working. It is just the habit I have build over the years. Even if the business is doing well after the first year, I wouldn’t really believe that It would be consistent if I would work less than 20 hours per week. I need to be there, I need to talk to my clients, coming up with marketing strategy, building up a product, hiring, making deals and developing my dream.

The picture above demonstrates my first working vacation back in February 2016. I still worked 5 hours every day on my vacation. Crazy? Mabe. Rewarding? In more ways than one. 🙂

Unitizing our client’s Dashboards – Incparadise, Startupr and Eqvista

As we have several companies in our group, we would like to unitize their platform UX&UI. Based on my own experiences, I think that it is more important to work on the product rather than on the web design. It doesn’t really matter whether you have a cool website design if your product is really bad. The most important part of the business is happening outside the online world. Prior to any successful online project there is the idea. Here at Incparadise, we have handled all services perfectly, meaning, if we receive orders at our backend – inccontact.com, we know how to process it effectively and timely. Since the company has been set up back in 2002, our company website has been redesigned several times from a very generic website to a robust, one-stop solution for any company formation in all 50 states. However, as time goes, we think that it is important to keep up with the trends in the industry and continue with more simpler, modern designs, although I don’t believe that it would actually increase business. It is important to make small changes in order to let our clients know that we are constantly alert making necessary changes in the development of our services.

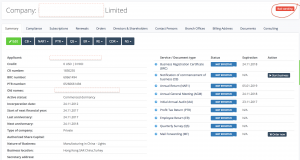

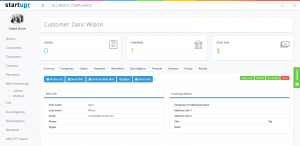

We want to start first with our front office. Once you set up your company and you login to our online management system, you will land on the dashboard:

The design has not been changed much, it is still our old, classic design. However, since it was sufficient at the time when the company was set up, there was no need to change it.

Our other company, Startupr, has its own software because the Hong Kong incorporation system and its jurisdiction has a different Company Ordinance compared to our US based company Incparadise. It is a modern platform that we have started coding just two years ago. It is just pure code, and we have not been working on the design as this was not our priority. Our target was to get it done as soon as possible so we can launch our application and start using it. However, the UI looks pretty good!

You can see that the UI&UX is modern.

When we acquired Incparadise we thought what to do next. As we formed all type of companies in all 50 states, we maximized all our options unless we branch out to different countries (for example Singapore). The only way to expand our business in the US was to open a second office in Wyoming and add several services (such as Secretary of State fillings) which had not been offered.

We guess we did a pretty good job. The next move is to come up with services which will assist current companies to also offer a Shares Management platform; this is why we came up with CapTable – management system eqvista.com

With regards to the design, we took the same approach as we did for our previous projects. We didn’t care much about the UI&UX. We focused more on the functionality and the code. We decided that we will offer a more cool design that will gamify the whole boring shares management system.

You can see a big difference, right? We will also try to unify the Incparadise client dashboard with the Eqvista dashboard so that, when you set up a company with us, we would like you to be comfortable switching from one platform to the next without noticing a difference. Incparadise helps you to get the company incorporated, and Eqvista will help you to manage your company shares (CapTable, Warrants, Convertible notes, Company Common/Preferred Shares).

Why did we decide to come up with new CapTable ?

1) We do company formation at:

Since our first day back in 2001, we have set up over 14,000 companies and received many successful stories where we assisted with setting up startup companies and where the company evolved into very profitable and successful business.

We have received many request on how to manage the company shares and how to issue convertible notes, warrants or options. There are many things to think about: how shares dilution works, or how to use waterfall analysis and why.

The key element is to have the correct shares distribution for investors or employees. You need to know the value of shares at the time of giving shares away or issuing shares.

409a Valuation – it is the appraisal of your company shares. If you deal with any of the following; raising capital or rewarding your employees with company shares, you need to know what is the current price of your company’s common stocks.

Publicly traded companies have valuation displayed at the stock market which is updated every daily or even by the second once the market opens. However, the valuation for non-public companies must be done by appraisal specialists (accountant, CPA or any experienced financial professional). The 409a Valuation is required only for US incorporated companies. This appraisal is required by law.

As you can see, there are many things to think about! This is the main reason why we have decided to provide you with Capitalization Table services. We already have clients and we are sure that Incapardise Inc. will be the right fit for eqvista.com. Incparadise Inc. is Registered Agent based in California, Wyoming and Nevada providing Secretary of State corporate filing services. We are capable to provide easier access to CapTable management services.

We do have clients who might simply use just the part where they manage company shares and need readily accessible and comprehensive online tool for their shares.

We have over 2,000 clients in Startupr who like to get access to this wonderful tool. The Hong Kong jurisdiction is different from that of US, especially the taxation is simpler and more benevolent which makes the 409a Valuation necessary; however, as a founder of Hong Kong based companies, you still need to valuate the shares if you sell them or award them to your employees. This is why we are convinced that any Hong Kong company will benefit from our services.

We offer our platform free of charge and we might also add some paid services. 409a Valuation is heavy lifting work, as this service involves professional manpower. As there are many competitors, we will have to come up with a competitive pricing.

2) Competition

Current versions of CapTables are not satisfactory; the competitions provide, overly simple or overly complicated platforms.

Simplicity is the key to attract more clients; the product should not look too cheap otherwise the clients wouldn’t trust that platform to put company’s data on it.

Complicated platforms are business killers as they are difficult to use. You do not want to spend your precious time on updating your CapTable more than necessary, you shouldn’t be discouraged by difficulties of uploading your shares to the platform by potential difficulties.

Therefore we have recognized an opportunity, to make available a intuitive online platform which will encourage you to play with your shares and have a fun while deciding distribution of your company shares. We know that it is very important to be able to trust your CapTable and instead of spending too much time on filling the columns and rows of your spreadsheet.

3) Delaware & Wyoming law changed and welcomes blockchain technology

Delaware Blockchain Initiative

As the technology evolves; the law and provision do the same. Delaware has come up with Delaware Blockchain Initiative (DBI) where you can hash your shares on the blockchain. Let say that you have issued 100,000 shares to yourself and to five other founders plus three investors. except that you have no record of the shares in the data entry of your Excel sheet. Also if you lose your excel sheet, you will end up having no record either. DBI is a provision which allows you to use the distributed ledger (the blockchain) to store all your data. In this way, the information is stored in unerasable data storage. This is the advantage that our platform provides.

Wyoming HB 101 provision

The same provision has been passed in the State of Wyoming where also you can use blockchain to store your data. HB 101 provides for the maintenance of corporate records of Wyoming entities via distributed ledger.

Here are a few reasons why it’s good to store your data on the distributed ledger:

- Cost savings, error free defensible (once there is an entry in distributed ledger, it is almost impossible to forge the data entry);

- Always accurate and it automates most of the manual processes that business are paying law firms and always accurate (the algorithm automates most of the shares data entry therefore the system is mistake free – each transaction is cryptographically signed);

- Every shareholder can be directly registered on the distributed ledger (blockchain)

- Instead of being beneficial owners through broker, you are the owner;

- CapTable management is very easy (no need to hire accountants or lawyers);

- Lowers the chance of disputes;

- The technology allows two parties to interact directly without an intermediary;

- And many more.

Just to wrap it up why we have decided to start our own CapTable firm.

We have a great client base. Incparadise has been in the business since 2001, Startupr has been on the market since 2011, we have incorporated over 14,000 companies. We average about 4,000 active clients from year to year. Every single company must issue shares by law, therefore you need to have a record of company shares. This is why we are here for you.

We have opened a new office in Silicon Valley, we are in the right place to provide startup services as CapTalbe and Valuation company.

The law changes constantly and it brings other possibilities for entrepreneurs on how to develop new products; this is one of the reason why we have used blockchain technology in our platform. It is fail-safe.