Pre-revenue valuation method

Before you raise any money from investors, you need to make sure that the company value can be justified. I know that this is a very difficult task. However, there are several methods to get it done. One of the major problems with all methods is that you need to justify why you are asking for that particular amount of money. I was always skeptical when raising money, and giving up equity if the Startup is your only income. Your company might be super successful but you realize that you have lost equity due to the fact that you needed an investment. My suggestion is that you should not give up your equity at this early stage as you can end up with little stake in your company. Of course, the investors are motivated to leave you enough so you can feel that your all work will be awarded, however, investors might also be very eager to take a big chunk of your company. Once the company has some revenue and you can demonstrate that you have a strong team, market share, revenue, and product, it is far easier to raise money and give up just a little of your company share in exchange for the initial investment. So how do you prepare for the financial projection? Please remember, that every investor would like to know the justification of the amount you are proposing.

Here are three methods I like the most. The fourth method is created by me. 90% of all investments are unsuccessful. Most of the startups go bankrupt. They don’t survive the first year or two years.

Berkus Method

This method is based on 5 elements:

- Sound Idea (basic value, product risk),

- Prototype (reduces technology risk),

- Quality Management Team (reduces execution risk),

- Strategic Relationships (reduces market risk and competitive risk),

- Product Rollout or Sales (reduces financial or production risk)

Each element has a maximum value of $500,000 where you assign the value on your best judgment which can be proved.

For example, your Strategic Relationship with the current client might bring $500,000 net income to the company so you will put $500,000 as this is the real value of your special condition valuing the element on the higher number possible.

If each element earns a maximum valuation of $500,000, you will end up a valuating company of $2,500,000.

In our case, we have valued each element of the company with much lower $$$ as the management or team is the only valued asset, we put the higher value to that element. The total Pre-money is $875,000.

We will offer these tools for free of charge as far as it might increase our traffic and get a few clients to start using our platform. If you look at the There are quite a few competitors who are well established, Every company.

Scorecard Value Method

Scorecard Value Method is mostly used by the Angel Investors.

The first thing you need to do, it is to find in your region or market similar company being valuated. You take into account the average value of the investment. You take the Pre-money valuation value.

I would be looking at the Angel list and see what numbers you might fit into.

The second element is to compare the startup to the perception of other startups within the same region using factors such as:

- Strength of the Management Team (0–30%)

- Size of the Opportunity (0–25%)

- Product/Technology (0–15%)

- Competitive Environment (0–10%)

- Marketing/Sales Channels/Partnerships (0–10%)

- Need for Additional Investment (0–5%)

- Other (0–5%)

The ranking of these factors is highly subjective, I have the same problem with this method as with Berkus Method. If the investor will ask you why you have come up with that particular number, you need to be ready to answer that question. It is the same approach as we have with Berkus Method.

Risk Valuation Method

You need to come up with the average value of the similar Startup in your region. We can come up with an example of $1,000,000. Once you have that, you will need to assign a risk factor to each element. Risk factor +2 very positive, +1 positive, 0 neutral, -1 negative and -2 very negative.

The initial pre-money valuation is adjusted positively by $250,000 for every +1 and negatively by -$250,000 for every -1, $500,000 for every +2 and negatively by -$500,000 for every -2. You will minus or plus each value from each other and you will get a number which you will sum up with the averaged value of all similar companies in your area.

- Management

- Stage of the business

- Legislation/Political risk

- Manufacturing risk

- Sales and marketing risk

- Funding/capital raising risk

- Competition risk

- Technology risk

- Litigation risk

- International risk

- Reputation risk

- Potential lucrative exit

Each risk (above) is assessed, as follows:

- +2 very positive for growing the company and executing a wonderful exit

- +1 positive

- 0 neutral

- -1 negative for growing the company and executing a wonderful exit

- -2 very negative

Once you have the above math done based on the values assigned to each element, you will get a result.

By the way, here is the current stage for each investment. Before I moved to the Bay Area, I didn’t know that there is something like Pre-seed. We have just Seed Round in Hong Kong. I guess the Venture Capital environment is very unique compared to any other places in the world.

Here is the table:

- Pre-seed: raising $200K – $500K at a pre-money valuation of $1M – $3M

- Seed: raising $500K – $2.5M at a pre-money valuation of $2M – $6M (expected revenues are $0 – $50K per month)

- Series A: raising $3- $12M at a pre-money valuation of $10M – $40M (expected revenues are $100K – $250K per month)

- Series B: raising $10M – $25M at a pre-money valuation of $30 – $100M (expected revenues are $350K – $800K per month)

- Series C: raising over $20M at pre-money valuations of over $100M (expected revenues are over $1M per month)

How to make $1,000,000 in revenue within a few days!

Education followed by the implementation of the learned knowledge is everything. Well, it is easy to say but many coaches are building up their carrier on this very pragmatic piece of advice. There are actually many of coaches and they got my attention because they have a wonderful business and I do respect them; however, they just tell you how everything is great if you follow their advice or idea. But I am afraid that their product is just great marketing.

YouTube, Facebook or LinkedIn advertise these self-proclaimed influencers who give advice on anything, how to become the best online stock trader, house flipper, online marketer, etc. I would really like to know who makes a fortune who makes a fortune following these specialists.

Of course, there might be a miracle and you could get very successful following their advice but I would be very careful with regard to whom you trust.

These coaches usually use the example of one of their students to demonstrate how their teaching skills really helped and try to convince you that this could be you within a few years or even months.

It really reminds me of the old fashion joke with sugar.

So, here is the deal of how to make $1,000,000 revenue within a few days!

- Buy $1,100,000 worth of sugar.

- Sell for $1,000,000.

- Boom. $1,000,000 in revenue !!!

This is actually how some of these companies and their founders operate. Again, there might be a few lucky people who really succeed and can get great business but from my own experiences, it takes time and loads of effort to get to the point of where you have achieved your goal!

Don’t believe anyone who tells you that they have the secret to success and focus instead on your essentials and your instincts, everything might look good but the truth is likely somewhere else.

I’m not saying that you shouldn’t listen to any of these people but be careful who you follow, because in reality it might be that their business has $1,000,000 in revenue but is losing money. They might just build up their portfolio based on a marketing strategy and the product might just be their faces and a rented private jet in the background! Actually the opposite might be the truth and their company is losing money while they present themselves as somebody who is really successful.

Read everything and follow anyone who covers your topic, but remember one thing: You have a different business case, you are in a different environment. Choose your own path instead, it is much better than believing in others’ revenue.

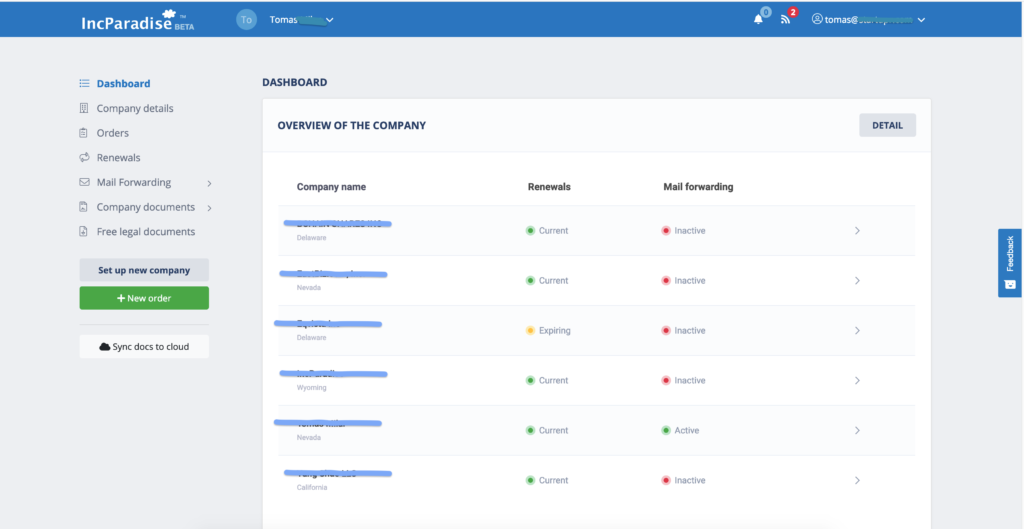

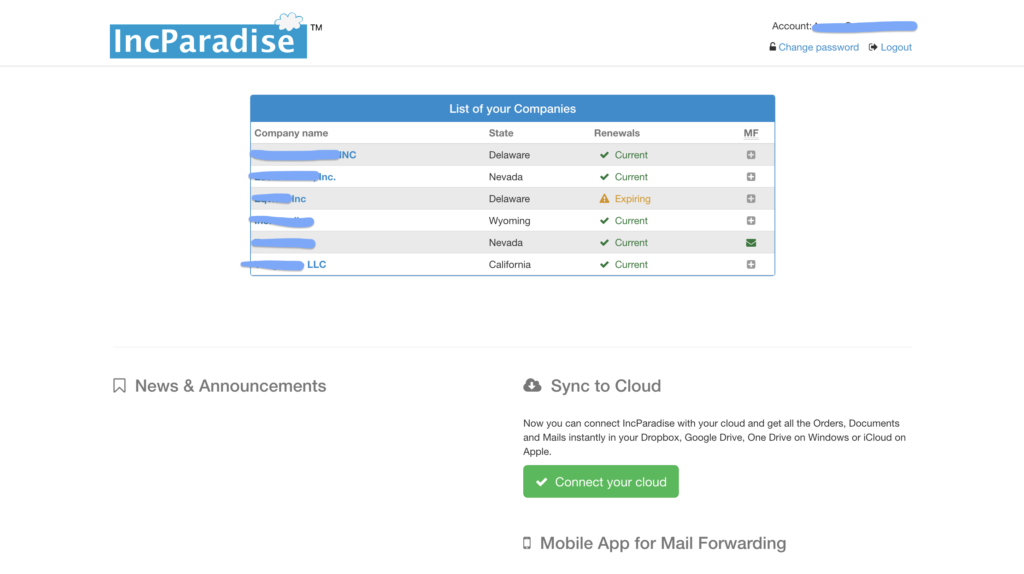

Incparadise New DashBoard

We have some good news to share. The good thing is that our IT team has finally launched our new DashBoard for IncParadise. I was pushing them very hard. Since we are working on multiple companies, it is nearly impossible to be on time. Anyway, it is finalized, and we can move to other improvements. We have a list of things what we want to do.

This is our New DashBoard

This is our Old DashBoard

Our mayor improvements:

- We have placed all companies on one webpage, so you don’t have to go through all separate pages for each company and have all services in one place.

- Mail Forwarding box is displayed on the dashboard, so you don’t have to click through different subpages, you have all your incoming mail on your dashboard. Add funds to your Mail forwarding: You can add funds to your mail forwarding account at any time. You will also get a notification in the system when your deposit funds drop below the limit.

- You can place New Order for any services or your current company, so you don’t need to go to the public order form. All can be done from the DashBoard.

- Service Expiry Notifications: Users will be notified about their service expiry or any other important company filing deadlines.

- You can Incorporate New company from the dashboard, any company out of 50 US states.

- Pop-up of your dues – Company Renewal, Annual List, Mail Forwarding Renewal.

- Eqvista – you can issue and manage your shares, set up ESO (Employees Stock Options), Convertible Notes, Option, Warrant, SAFE & KISS.

- New and Improved system for managing and storing company documents.

- A new version of cloud services for Dropbox and Google Drive.

- Easy & Advanced user interface.

- Fully responsive to the mobile & web.

- Advanced security & privacy protections.

I will be very happy if you have any suggestions on improving our DashBoard. Please leave comments below. You can set up your company and

Regulation D, Rule 506(c) Blind Pool Offering – Brilliant option of raising funds

Regulation D, Rule 506(c) Blind Pool Offering is a brilliant way to raise a funds in the USA. There are several aspects you need to full fill:

Why would I need to register a fund? Well, it’s simple answer. Financial sector is heavily regulated and you can not fund must fullfil

- You need to submit Form D to SEC

- Once you recieve an investemnt to your fund, you need to notify

- You can advertise your fund

Purpose of the private equity fund:

Relocating to another place – How do I create my space?

I have moved several times in the past 15 years. People always ask you, how did you figure it out? How can you manage your life if you move to a completely new city or country? Well, it is very simple. I will cover what you need to do in order to relocate successfully.

First, make sure that you know what you are going to do in that city. Some people think that they can move to a certain country without a plan. If you are a student, make sure that your university or school has accepted you and you can study. If you are done with a university or former education, make sure that you have a job and a place to stay. If you are starting a business, make sure that you set up a company before arrival and have a plan.

Again, the whole point is to have a plan. Many people don’t have one and of course, it might happen that the plan goes wrong. Of course, it can happen in your home country as well. Nothing ever goes as exactly as planned; the key is to eliminate the odds against you.

So, when I was a student, I already knew which university I would be attending before I arrived in the country of my choice. I knew where I would be living, so I made sure that I would have accommodation for at least the first months, but the whole point of relocating is to be part of the city as soon as possible. You can not relocate and think of finding a school or accommodation after you arrive. Speaking from my experience, I would suggest you do your homework before arrival.

If you are relocating for business reasons, start your company first, prepare by working on it for 3-6 months, secure a visa (this is crucial, there are people living in countries for years as a tourist and re-enter after three months, to prolong their stay). Once you know a lot about the business, you can relocate, get clients and work on your business. It sounds trivial but many of us don’t do that. They think that they relocate and figure out what does work and how to go about it. If you prepare, you save time and money. Efficiency is the key.

So before any relocation; make sure that you know what you are going to do. When I was relocating from Beijing to Hong Kong, I was studying for six months all the Hong Kong company ordinance so I could offer company formation services immediately. I saved a whole six months. Startupr became profitable within three months. The preparation was the key. I can not imagine that I would start my research after I would move to Hong Kong, I would waste six months. I know that you might have a job or other duties but this is the key to the game. When you get home from regular work, you have another 6 hours to study.

I know that this sounds repetitive but don’t neglect the preparation and do your homework. It is not easy, but getting out of your comfort zone. It will pay off! Entrepreneurship is a lonely word; nobody is going to tell you what to do, no one will guide you or support you – these feelings will multiply once you relocate. So make sure that you know exactly what you will be doing and prepare.

For six months I had studied Hong Kong Company Ordinances following my relocation. I would start my day in the new city as I was completely into work and knew my schedule since I was studying and working on the company; I had a goal, therefore the relocation didn’t distract me. The day would start just as if I was in the original place. It didn’t seem in any way that I was in a new town. I had my company and a plan and had already worked on it for six months.

Startupr among 10 hottest startups of 2012 – We have 2018

When I set up Startupr back in 2011, I had just one

simple mission, and it was to get enough client to cover expenses and

grow the business. Now, we have several offices around the world and

expanding our services rapidly.

Where do I see Startupr in other five years?

- We can grow our business and provide KYC solutions. It might look something like Thomson Reuters – we already have the platform, all we need it is to feed it with high-quality data

- We can expand our company formation business to other countries, mainly to South East Asia – Vietnam, Thailand, Singapore, Malaysia.

- We have launched our new service/company focusing on shares management – I am very excited to see where we can take this company as it is just a few days old, anything can happen. So we can become another global valuation platform.

- Startupr can remain as it is, the center of the incorporation services, we can be more the right hand of law firms outsourcing company formation to us.

Well, this is the plan, we have big ambitions since the group of our companies are growing quite fast, it is hard to predict the future. We have the targets, and we are working on all of them.

When I looked at the other companies from the 2012 list, there are not so many lefts. Well, it is also hard to see from their website where they stand now. But if you are not keeping up your website

Here is the list:

1. REALGOLDX – The REALGOLD™ Fund is raising funds to invest in physical gold bullion, RMB, Ruble and Yen structured gold products and the physical gold supply chain in SE Asia and the CIS, with a goal of exceeding the nominal performance of physical gold priced in: RMB, Rubles, and Yen. The company’s website is not up-to-date, the last blog post was published in July 2013. The website has also been changed. One might think that the company is not doing much of business or is closed.

2. Kidztown – bills itself as the first Japanese style indoor role play center in Hong Kong, providing exciting school trips and days out for kids aged 2-14. The website doesn’t exist, so I presume that the company is out of business.

3. De Dominicis – According to co-founder Andrea De Dominicis, De Dominicis is a response to the huge request of high-quality arts. Sorry, the page you were looking for does not exist or is not available. The company is out of business.

4. Ecopoint Asia – Ecopoint bills itself as Asia’s first web-based collaboration platform and resource hub exclusively for professionals working in the fields of climate change, environment, clean technology, and sustainable business. Sorry, the page you were looking for does not exist or is not available. The company is out of business.

5. Vibrant Communications – publishing multiplayer online games in South Asia, South America, and the Middle East. The website is up and running however there are

6. The Chinese TimeKeeper – a watch company – where designs embrace the unique an rich Chinese history and culture to offer watch amateurs around the world a new take in a Swiss dominated market. ” their website gets you a message “Error establishing a database connection.”

7. Alternative Turbine Technologies Limited – The company specializes in novel turbine technology to harness fluid flow energy. The website is also down, and gives you a message “server not found.”

8. Golden Fern Holding – a brand management company. The domain is for sale on the domain market; I presume that this company is also closed.

9. Track the Buzz – social media monitoring and analytics tool. Unfortunately, this company website is also down. They might be out of the business.10. Startupr Hong Kong –we are up and running. We also have big plans. There is always business difficulties, but you need to stay strong and do your maximum to get everything done properly.

These 10 startups are supposed to be the best for the 2012 year. We are so proud that we got that far as of 2018.

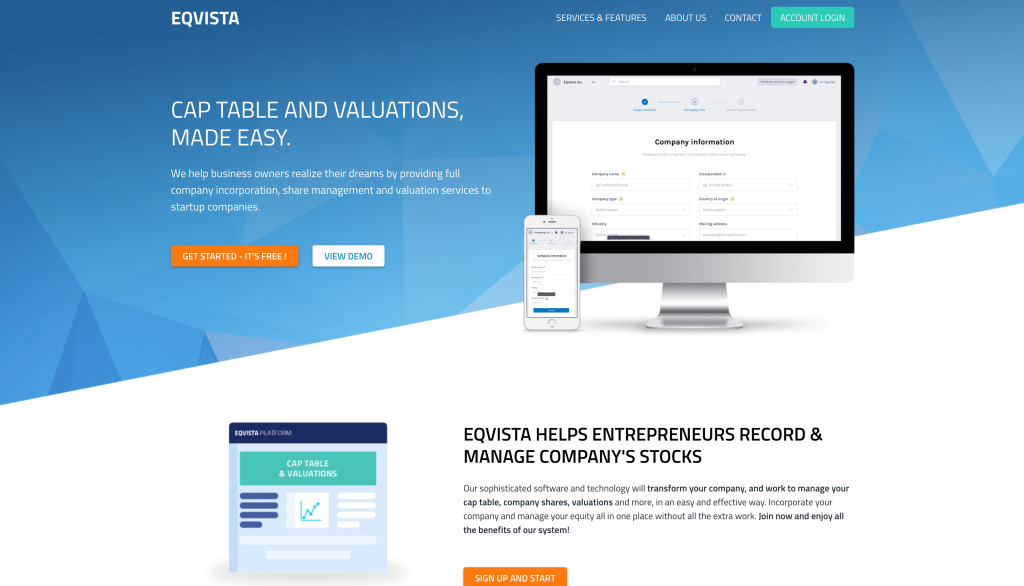

Eqvista is UP

We have been working very hard to launch our next company. Company shares management system. The system is free of charge.

The freemium allows you to:

- Add Unlimited Employees, Investors, Users

- Add Unlimited Companies

- Quickly see your cap table and manage all type of shares preferred or common

- Manage Convertible Note, KISS, SAFE recording, Issue options

- Equity Plan Management

- Manage Employee Stock Options (ESO)

- Set a Vesting of ESO

- Waterfall Analysis

- Financing Rounds Modeling

We will be charging for services as:

- We can help you to set up your Cap Table

- 409A Valuation

Please check out our new company Eqvista. You can create your own account and manage your shares in here.

MOVING COMPANY FROM Neveda TO Wyoming (SAME FOR LLC OR CORPORATION)

You can certainly do that. It is much easier than you think. Don’t be confused with foreign qualification – if your company expects to do business in a different state, you might expect to apply for a local biz license.

Reasons to relocate your company:

- Tax efficiency (e.g. Sales Tax purpose, State Tax) or different legislation

- Owners move the company base to different state

- Annual fees of the original state have gone up so you relocate to another state

- Expanding business opportunity

- Closer to clients

If your company is registered in Nevada you can relocate it in a few steps (you want to register your company in Wyoming):

MOVING COMPANY FROM NV TO WY (SAME FOR LLC OR CORPORATION)

If company is in good standings and current in NV:

1. Obtain a certificate of good standing and certified copy of NV Articles and any Amendments

2. Complete WY Articles of Domestication

3. Send to client to sign and return as WY requires original signed Articles of Domestication

4. Once Articles of Domestication are received, submit by mail to WY Secretary of State with Certificate of Good Standing and certified copies of NV Articles

5. Once Articles of Domestication received from the WY Secretary of State; submit NV Dissolution to NV Secretary of State.

If company is not in good standings and current in NV:

1. Obtain certified copies of NV Articles and any Amendments

2. Complete WY Continuance Articles

3. Send to client to sign and have notarized along with letter of resolution from client.

4. Once Continuance Articles and signed resolution is received from client; submit by mail to WY Secretary of State with certified copy of NV Articles

5. Once Articles of Continuance received from the WY Secretary of State; submit NV Dissolution to NV Secretary of State.

The business might maintain business history which is very much needed. As your clients, banking providers, or suppliers have better feeling about any company which has longer period of commencement of business.

How would you use $100,000 for advertisement

Every company needs to advertise. I am a big fan of online ads or organic traffic where you can measure results instantly. Startups doing business through online platforms usually advertise by using ads or trying to get organic traffic.

They also try to get as many investors as possible so they can attract the large groups of customers. It is called direct traffic; the company’s services are spread by word of mouth, one way to obtain direct traffic.

This picture is of the company called eshares Inc. (not giving the backlink); based on the CrunchBase data they have received investment from many investors so it is in the investors’ interest to start using their platform. However, they have definitely neglected the organic traffic. This might be due to the fact that their product is great and they don’t need any advertisement. Social and Affiliate marketing is also very low. So I guess that the biggest traffic is from investors and linked to word of mouth which is the greatest low-cost marketing possible.

If you look at another picture, it shows that the organic traffic for company Capshare is the mayor marketing tactic (again I am not giving the backlink in here) for many reasons 🙂

We did our homework; yeah! We spy on our competition! Actually, we have not, and for one reason. When we were coming up with Eqvista, we didn’t really know that we would launch another company. We were just looking at the capitalization table function and realized we could add it to our current company services. It would be offered as extra service so you would be able to manage your shares. The captable is very complex and difficult to code, it is not easy without a solid background and an IT department. Although we already had all of it. Iit took us some time to get to the point where we could make it.

So now, here is the assignment. You have $100,000 to use for advertisement. How would you use it? Would you rather hire an online marketing company, or hire more people to advertise and where you might end up with the wrong campaign and burn all your money just to get a few clients. You would have to constantly invest money into the PPC or even work on the organic traffic. Or would you invest money into the new tool which would encourage and reward your current clients and to also attract additional clients? We have chosen the second choice, we have come up with a way to build up our own tool, based on our current online platform and get it done low-cost. I believe that this is the right way. We do have a marketing department working on our group companies’ websites, however, I take this as a big challenge and an option to get the maximum out of a minimum investment. Since we have branches all around the world, we have easy access to high-quality manpower at a reasonable price.

So here is the upshot: either burn money on the advertisement or, alternatively, come up with an online platform and extend your current services? What would you do?

Should I set up LLC or INC?

We have quite a lot of questions here at Incparadise about people should start LLC, Corp C or Corp S. Since this questions very complex it is very difficult to answer the question. While answering this question, it doesn’t really tell you which entity you should set up. I will try to give you a few hints when and how you should make a decision.

Limited Liability Company

LLCs are structured as managers and members. Managers are responsible for the company decision and members are the owners.

LLC provides legal asset protection.

Taxation: You pay taxes at the personal level so whatever you earn, it will be regarded as personal taxation.

Investors will always prefer that you set up a C corporation because you can issue your investors’ common shares or more likely preferred shares.

You can not distribute shares to employees. Meaning, LLCs do not give you an option to set up Employees Stock Options (ESO).

Since the company doesn’t have shares, you would have to mention in the Articles of Association the percentage of the ownership of each member.

LLCs are mostly much cheaper to maintain with regard to yearly fees. For example, if you set up a company in Nevada or in Wyoming, you will likely pay very little.

LLCs are very good for owning properties or small businesses.

S Corporation

You convert your C corporation to S corporation. An S corporation functions as an LLC legal entity from the tax point of view.

An S corporation provides legal asset protection.

Before you convert C corp to S corp, make sure that you understand the consequences. The issue might be that the conversion might be costly and you might realize that it was a wrong decision in which case, you will have to convert the S corp back to C corp.

C Corporation

This is my favorite entity. And I would say that 99% of all Silicon Valley startups go for C corp preferably incorporated in Delaware (Why Delaware? This is for another topic).

C corporations provide legal asset protection.

You have directors and shareholders. Directors are the responsible bodies for company decisions. They pass any important resolution into effect.

Shareholders are the owners of the company and elect the directors.

C Corporations have several features which can be used for any startup.

The company has 2 types of shares: Preferred and Common.

- Preferred shares are mostly issued to Investors (They have many preferred rights over common shares)

- Common shares are mostly issued to founders. The founders also create the Employees Stock Options (ESO). If you issue ESO, you would need to set up the striking price, vesting schedule and year cliff.

When you are issuing new shares or looking for investors, there are also many new terms you should study:

- KISS (Keep It Simple Security) – released by 500 Startups (open source document). It is a debt interest. The key is to keep the fees low so you can use it whenever you feel you don’t need a lawyer

- SAFE (Simple Agreement for Future Equity) – it is similar to KISS (open source document). Released by Y-Combinator. It is not a debt and has no maturity date or interest. Investors give a money today for the future equity.

- Warrant – It is like an option. However, there are differences; it is issued by the company.

- Convertible Notes – short-term debt issued by a company to the investor. Convertible notes are usually converted into equity.

Incparadise has also many questions; if any US-based bank opens a bank account remotely for startups, the answer is no. All banks require you to come to the US and open the bank account in person. There might be some exceptions such as Silicon Valley Bank but your business case must be strictly high-tech as SVB is based in the Bay Area; it is quite obvious who the typical clients are, mostly high-tech and IT startups. When I was talking to one of the Bank representatives, I was told they also offer financing and have great connections to Venture Capital.